It is still early to take a fully-fledged picture of the impact of coronavirus pandemic on the real economy. The size and the speed of the recovery are still subject to debate. Some economists believe that the global economy is on its recovery pattern, while others say that we did not reach the bottom yet. The only sure thing is that in most central banks from developed countries printed huge amounts of fiat currencies and governments issued significant volumes of debt. How this massive debt will be served in the future, and what is the impact on tax evasion?

Issuing debt is an easy way to get by during a crisis. The British economist Ricardo pointed out in 1820 that issuing a significant amount of debt to cover expenses of a crisis is economically equivalent to levying of a tax of the same amount and transfer it to next generations. This debt strategy is nothing else than a “fiscal illusion”.

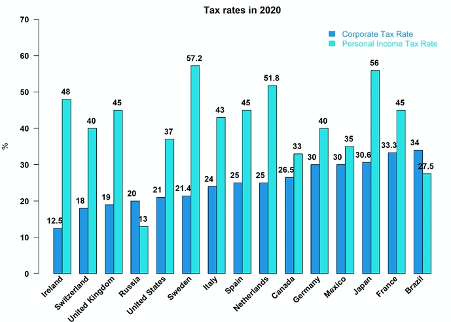

In practice, this “fiscal illusion” means that one should expect over the next decade a continuous increase of the tax rates. On the one hand, governments need to keep the corporate tax rates reasonable to attract new business and to support the recovery. On the other hand, the only avenue left to collect more monies is to increase the personal income tax. Most developed countries have already a tax rate bigger than 30% for individuals. Some jurisdictions offer some leeway with lower taxes on capital gains. But for how long?

Needless to say, that amid the current turmoil, a few high net worth individuals are already planning how to protect the fruits of their labour. It is reasonable to believe that a new wave of tax optimisation will start in the last quarter of 2020. The boundaries between tax optimisation, tax avoidance and tax evasion are murky, and one thing could lead quickly to another. In the aftermath, authorities will point the finger at banks and Fintechs. So, what can be done?

Most financial institutions are engaged in refurbishing their outdated KYC/AML systems. This effort may prevent several types of financial crime, but may not be useful to detect, for instance, a CumEx strategy developing into a tax evasion scheme. Having a dynamic and proactive risk assessment process can mitigate at a certain extent, the risk of harbouring clients involved in tax evasion. But, gathering intelligence continuously about customers' behaviour may become the only way forward for financial institutions.

“Always overpay your taxes. That way you’ll get a refund.”

Meyer Lansky, American Mafia associate

Tax evasion: Turmoil in the European Aristocracy

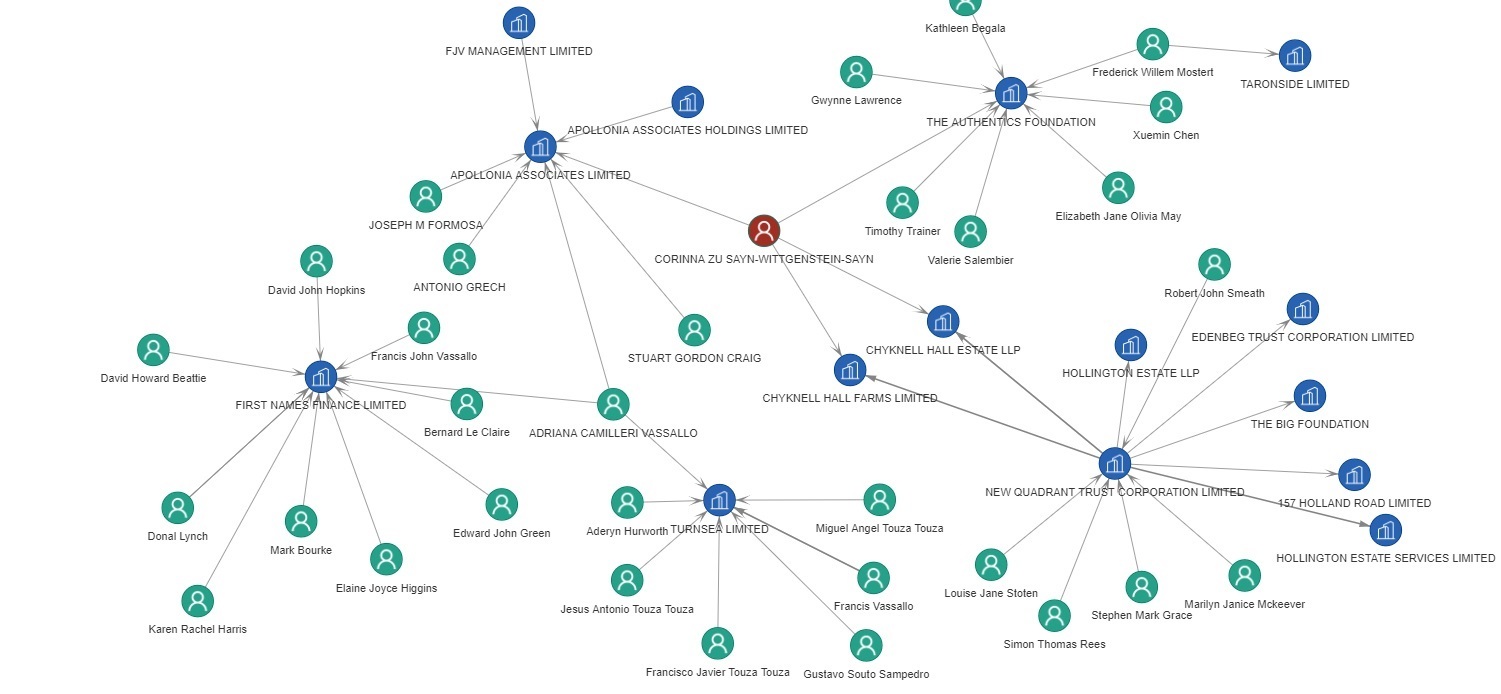

Spain's ex-King Juan Carlos left the country amid an investigation for tax evasion. He is allegedly involved in corrupt dealings, including international transfers of tens of millions of dollars. He has supposedly received more than 100 million dollars from Saudi Arabia's King and transferred part of the proceedings to his companion Corinna zu Sayn-Wittgenstein.

Corinna zu Sayn-Wittgenstein, a Danish citizen, born in January 1965 is seemingly the key person in this scandal. Her name appears in the Paradise Papers leaks. She married and then divorced Prinz Niclaus zu Sayn-Wittgenstein, thereby acceding the closed milieu of European aristocracy. Corinna zu Sayn-Wittgenstein was connected to a big network of companies based in Monaco, Malta, the United Kingdom, Ireland and Spain. The connection with Spain seems to operate through Apollonia Associates Limited, a Malta-based company which is currently closed.

Money Laundering: Danske Bank

Danske Bank's alleged involvement in the "Russian Laundromat" may have an unexpected outcome. The Danish bank may not get fined by the US authorities for its insufficiencies in its AML framework. The biggest money-laundering scandal in modern history brought down Danske's reputation, which transacted up to 200 billion euro of non-resident money through its Estonian subsidiary from 2007 to 2015. The amount of the potential penalty inflicted by the US would probably reach several billion dollars. Thus, it could have been a massive burden for Danske, which is already implementing a big project involving more than 2,000 persons for rebuilding its AML processes.

Focus: HSBC

HSBC's share is at its lowest point, and the future does not look very bright for the London-based bank. The pandemic outbreak and the political turmoil in Hong Kong are hindering its growth opportunities. Moreover, HSBC seems to be caught in the middle of a proxy-war between the US and China. In early August, Jimmy Lai, a prominent voice and supporter of the Hong Kong protests was arrested by the Beijing authorities. Its personal and business bank accounts with HSBC were frozen. Consequently, HSBC's relationship with the Western governments reached a boiling point. The proxy-war with China had begun in June when the Trump administration initiated a series of sanctions against Beijing-based political figures involved in the repression of Hong Kong protests.

HSBC not only that has a complicated financial year but is also coming after a long series of investigations and penalties for breaches and insufficiencies concerning its anti-money laundering framework. Addition penalties related to the Chinese situation would constitute a severe threat to HSBC's stability.

Word on the street: Obituary

Last week the criminal world lost two prominent figures:

Frank Cullotta (1938-2020) a flamboyant mobster portraited in the Oscar-winning production Casino died last week. Cullotta was a "made" member of the Chicago Outfit before he turned informant and cooperated with the Federal government. During the golden era of the Vegas connection, he was part of the criminal group that oversaw the Nevada investments in casinos of the Milwaukee-based organised crime.

Nadir Nariman Salifov (1972-2020) was an Azeri crime leader part of the "thieves in law" (vhor v zakone) criminal fraternity. After spending most of his life in prison, he was released in 2017. He was arrested in Montenegro shortly after the failed coup-d'état against the local pro-Western government. He was assassinated last week in a hotel in Antalya, Turkey.