The European Parliament asked to halt the construction of the “Nord Stream 2” pipeline, a gas line between Russia and Germany. The demand comes after the arrest in Moscow of Alexander Navalny, the Russian opposition leader. The arrival of a new administration in the White House is not a source of optimism for Kremlin. Thus, Russian officials do not expect any improvement in bilateral relations. Are these signs of a new Cold War? What will be the foreseeable impact on compliance and AML?

The Cold War ended more than three decades ago, and President Regan claimed victory in front of a deceased opponent. Lubyanka bureaucrats, on the other hand, praised that they engineered the entire thing in order to undermine the West in the long run.

While the previous Cold War was territorial, the new conflict could be ubiquitous. The world is more divided than ever, and a new geopolitical conflict would bring division within every country and every stratum of society.

Russia has a troubled past with Western democracies, and the Beijing regime receives more and more critiques from its old allies. In this polarised world, a new Cold War would not be militaristic, but economic. In this new configuration, financial institutions could play a key role. New sanctions against Moscow could trigger a real financial blockade.

What will be the impact of such a scenario upon financial institutions? The new Cold War will lead to proxy battles in the banking world. Banks will be more cautious when offering products to multi-national companies or high net worth individuals. Moreover, banks would need to reinforce their compliance functions and enhance their internal Financial Intelligence Units. Institutions like neo-banks or fintechs that will not have enough resources may subcontract this work to private intelligence firms. In this new context, the big winners will most likely be private intelligence providers.

“For 40 years we were led to think of the Russians as godless, materialistic and an evil empire. When the Cold War ended, we suddenly discovered that Russia was a poor Third World country. They had not been equipped to take over the world. In fact, they were just trying to improve a miserable standard of oppressive living, and couldn’t. They had to spend too much on arms build-up. We didn’t win the Cold War; we bankrupted the Russians. In effect, it was a big bank exhausting the reserves of a smaller one.”

Norman Mailer, American novelist

Crypto: Fears of double-spending

Every digital coin based on decentralised distributed ledgers needs to address the risk of double-spending. In layperson terms, double spending is the risk that two different payments use the very same coin. Thus, the same amount of currencies could serve to purchase two separate items. In the world of physical fiat currencies, the problem does not exist. Traditional banks certify through their centralised ledger systems that double spending does not occur.

Last week, Bitcoin, the leading cryptocurrencies lost more than 10% of its market value amid rumours that double spending took place in the ledger. The likelihood of such event is in theory very low. It is related to the probability that an account holder which is also a miner validates its own transactions. Also, if two miners are validating at the same time two trades using the same coins, double spending is possible. While this risk is very low for Bitcoin, it can become material for coins where the mining process is very concentrated. If a mining facility accounts for more than 50% of a given coin’s total mining capacity, the risk of double-spending could become serious.

Focus: Julius Baer

Boris Collardi, ex-CEO of Julius Baer was reprimanded by Finma, Switzerland’s leading financial watchdog for his involvment in a money laundering case. The leading Swiss private bank had severe insufficiencies in the AML process that allow the laundering of illegal proceeds between 2009 and 2019. The bank was involved in several corruption cases linked to Petróleos de Venezuela, an oil company in Venezuela, and FIFA, the world football federation.

Collardi left Julius Baer in 2019 and got a leading managerial position at Pictet, another major Swiss private bank. After Finma’s reprimand, Pictet backed its new employee with full confidence.

Focus: Bank of Vatican

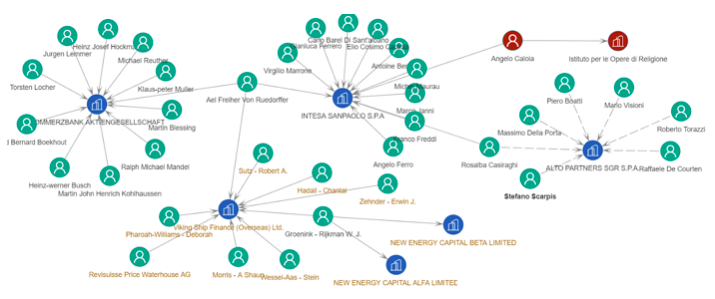

Angelo Caloia, a former head of the Vatican bank was condemned for embezzlement and money laundering. Caloia led the IOR (Istituto per le Opere di Religione) for over two decades between 1989 and 2009. He was convicted to eight years and 11 month in prison but is very probable that he will not execute the full sentence due to his advanced age (81 years old). Caloia and his co-defendants Gabriele and Lamberto Lizzo, both Italian lawyers, pocketed over 19 million euros from below-market sales of more than 20 IOR properties in Italy.

Caloia also served as director for Intesa Sanpaolo’s office in London. Amongst Intesa’s directors, there were several individuals with offshore investments that appeared in the Panama Papers.

Pope Benedict XVI initiated a massive clean-up in the previous decade, which was continued by his successor Francis.

Word on the street: The rise of the Albanian mafia

Last week, officers from the National Crime Agency raided several strongholds of an Albanian crime gang operating in London and Essex. Four Albanian nationals Rrustem Dauti, 30, and Fisnik Kurtucai, 32, Florian Mehsi, 22 and Azem Gashi, 26 were arrested for money laundering and drug trafficking.

The search team recovered 340,000 GBP and over six kilos of cocaine. It is not a secret that Albanian gangs control London’s underworld, and they are specialised in cocaine smuggling and wholesaling. Brexit may bring some changes as the freedom of movement between Britain, and the continent will be massively reduced.