Robin Hood, the legendary English heroic outlaw, took money from the rich and helped the commoners. The homonymous commission-free trading and investing app seems to have a different approach. The “Gamestop” bubble created by retail investors’ erratic behaviour reveals the real weakness of the stock market pumped artificially by the money printing machine. Regulators will investigate into this matter, while “commoners” may take the case to court. How will the future judge this episode? Fraudulent market manipulation? Or just a revolt against Wall Street?

Before going into further detail, we note there has never been a better time in all of history for fraudsters to abuse financial markets. The neverending quantitative-easing resulting in the injection of massive amounts of monies into the stock market led to an irreversible disconnection between market prices and economic reality. Therefore, there is no method or approach to reasonably detect market abuses, pump-and-dump scams or price manipulations in the current environment. The disconnection between price and fundamentals erases all red flags that would highlight in ordinary conditions a fraud on the market.

The fraud-on-the-market theory emerged in the late 1960s and is the legal foundation that enables plaintiffs to attack any material misrepresentation regarding a security traded in the open market that affects the price of the security. Pursuant SEC Rule 10b-5, investors are entitled to the presumption of reliance if they demonstrate that a public misrepresentation impacted positively the price.

In the Gamestop case, investors were aware that the issuer had negative economic perspectives. They decided to “long” the market knowing that they will lose in the end, but aiming to bring into insolvency a major hedge fund. Robinhood decided to halt Gamestop-related transactions amid fears that irrational traders will create a massive turmoil in the market. Robinhood representatives explained that their decision aimed to protect individual investors who were buying the stock at an overinflated price. Were they protecting their clients or the hedge funds?

Retail investors were aware of their “suicidal” bet and did not require any protection. Thus, Vladimir Tenev and Baiju Bhatt, Robinhood cofounders, may need to provide a better explanation for their actions to both regulators and clients. If hedge funds needed help, it means that the individual traders were part of a conspiracy to misrepresent prices. The presumption of reliance could hold water if Melvin Capital opens a class-action against Robinhood and its clients.

Gamestop case will constitute a game-changer in the securities litigation landscape. In light of this assessment, market efficiency, fraud-on-the-market theory, and SEC Rule 10b-5 need to be revisited. A new conjecture should be introduced, stating that:

- A market with many informed investors can be inefficient.

- Retail investors can generate through their actions misrepresentation regarding a share traded publicly.

- Plaintiffs (including hedge-fund managers from Manhattan ) are entitled to the presumption of reliance upon the deceit generated by retail traders (including unemployed citizens from Iowa betting their COVID stimulus checks).

“In order to protect the firm and protect our customers, we had to limit buying in these stocks.”

Vladimir Tenev, Robin Hood CEO.

Attack of the clones: GPK Financial

The Financial Conduct Authority,Britain’s leading financial services watchdog highlighted a recrudescence of investment scams involving ‘clone firms’. A clone firm is a company which is not authorised or registered by the British regulator but has been targeting people in the UK, claiming to be a certified firm.

A common strand shared by all clone firms is that they use the names of genuine firms. Most clones are fictitious and are not actually registered with company houses. They have ephemeral websites and emails.

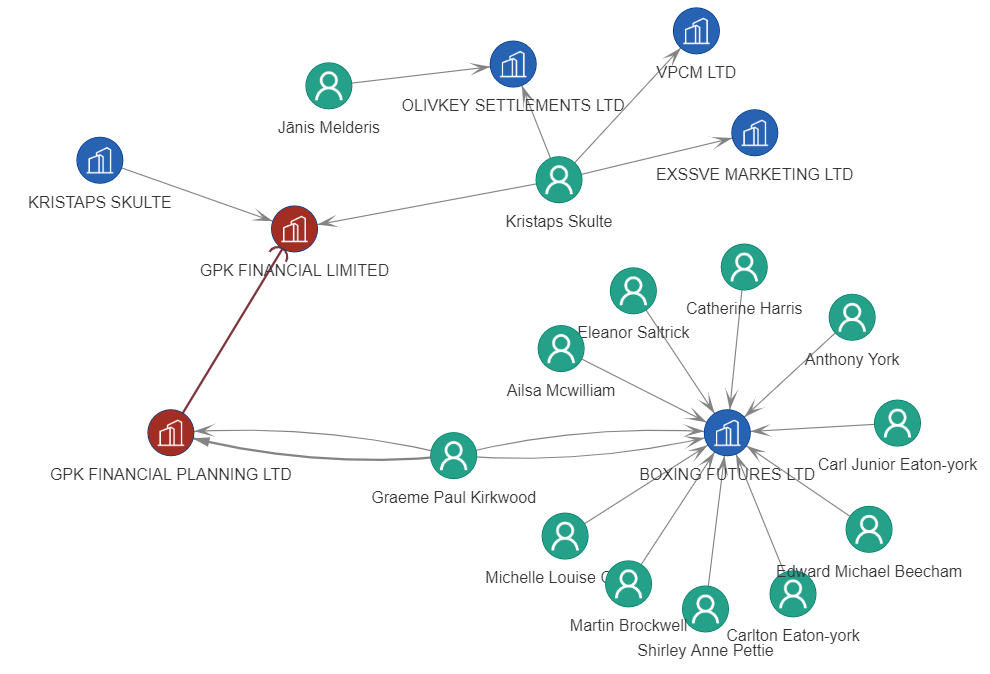

Nevertheless, there are clone firms that took this scheme to the next level. GPK Financial Limited is such an example. A legitimate FCA-regulated firm does operate since 2018 under the name “GPK Financial Limited” from Sevenoaks. Another firm with an identical name was incorporated in 2019 by a Latvian citizen. A Latvian company was controlling the GPK clone. It should be noted that Latvian-based companies can carry out investment service activities without a bespoke regulation. At a certain extent, as Latvia is part of the European Union, such companies can sell financial services in all member countries. Many Fintechs use this leeway. After Brexit, such schemes do not work for selling financial products in the UK, a special FCA approval being required. The British financial watchdog included the “GPK clone” on its list of unauthorised firms in December 2020 when the reg flags became obvious.

Focus: British Virgin Islands and corruption

The British Virgin Islands(BVI) is a British overseas territory, known as a tax haven. BVI became last year an EU fully compliant jurisdiction, being delisted from the non-cooperative countries list.

A corruption scandal erupted last week when Dominic Raab, the British foreign secretary expressed concerns about BVI’s vulnerabilty to serious organised crime. In the past, tax havens like Aruba or Montenegro were hijacked by criminal syndicates.

Representatives of the British government indicated serious corruption allegations related to local politicians’ role in public service. Moreover, they accused BVI administration that funds from the COVID support pack may have been re-allocated to political parties.

These accusations put the small offshore jurisdiction in a tough spot and could bring more suspicion to any BVI-incorporated firm.

The word on the street: New arrests in Italy

Italian law enforcement operated last week new arrests targeting prominent ‘Ndrangheta members, amid the biggest trial in country’s recent history against Europe’s biggest crime syndicate.

Italian police arrested last Thursday more than 50 members of Calabrian organised crime and in the same matter indicted Lorenzo Cesa, a prominent centrist politician. Cesa, a member of the European Parliament, is suspected of facilitating public contracts for the ‘Ndrangheta related companies in return for votes.

Lorenzo Cesa is the leader of “Unione di Centro” a small political party with a presence in the Italian parliament.

This indictment comes amid a political earthquake in Rome, Prime Minister Giuseppe Conte losing the majority and not being able to hold power. Seemingly, Cesa refused an alliance with Conte at the very same time the ‘Ndrangheta maxi-trial has just started.

There are many coincidences, and it is not the first time in Italy’s recent history. In 2006, only a few days after Silvio Berlusconi, prime minister at that time, lost the general election, the Sicilian Mafia leader, Bernardo Provenzano was arrested, after being fugitive for almost 40 years.

The connection between ‘Ndrangheta and politicians is not of recent date. In the early 2010s, a major operation of “Guardia di Finanza” called operation “Phuncards-Broker” showed strong ties between the Calabrian clans, telecom corporate executives and politicians.