Amsterdam has become Europe’s largest share trading centre, overtaking the City of London. The Dutch capital is in pole position to become a new global financial and business hub. But with new opportunities also come many threats. All major financial centres are facing massive challenges in tackling money laundering. Is the Kingdom of the Netherlands ready for such a challenge?

In the first month of 2021, the average daily trading of the Dutch stock exchange surged to 9.2 billion euros, pushing the City in second place, as its trading turnover halved over the same period. Moreover AEX, the leading Dutch stock index appreciated by 10% since the pandemic outback, while FTSE 100, the leading British large-cap equities index lost no less than 12%. Seemingly, the Netherlands show resilience to the current crisis, while its neighbour across the Channel is looking for a new direction amid a hard and heavy Brexit

Holland and Britain have competed since medieval times for supremacy in Europe for the maritime trading. More than 350 years ago, the Dutch fleet led by the legendary admiral Michiel de Ruyter entered the Thames estuary and severely damaged the British navy. The Netherlands is still a leading force in the freight and shipping industry, Rotterdam being Europe’s main port. Moreover, Holland is also an entrepreneurial hub, competing with London in attracting new businesses. A foreseeable development of capital markets can solidify Amsterdam’s position as Europe’s leading business capital.

Nevertheless, there are many lessons to be learnt, and the Kingdom of the Netherlands needs to give a sharp edge to its means for combating financial crime. With many offshore jurisdictions, including Aruba and Curacao and favourable legislation for holding companies, the Dutch government has many areas to explore to reinforce the prudential anti-money laundering framework. Many reports highlighted over the recent years, London’s role in the globalised financial crime phenomenon. Amsterdam can quickly face a similar fate. ING’s recent disarray of ING underlined that leading Dutch banks need to undertake further measure to step up their games.

“Be brave, my fellow, be brave! This is how you should act to gain the triumph”

Michiel de Ruyter, Dutch admiral

Sanctions: Russia - EU

Josep Borrell, the EU’s foreign policy chief, visited last week his counterpart in Moscow. Borrell probably imagined himself being Rocky Balboa that will defeat Ivan Drago in a political version of Rocky IV. Borrell went unprepared in Moscow, forgetting crucial aspects of Russian diplomacy. A quick lecture of “Karamzov Brothers” would have provided Mr Borrell with key pieces of intelligence:

- Russians do not negotiate when threatened.

- Russians do like asymmetric situations, even when they are not in their favour.

- Russians do opt for simple strategies like severing all ties with the enemy.

- Russians do use strategies based on “sacrifice” chess tactics.

- Russians do become united when confronted with adverse hopeless conditions.

Mr Borrell’s approach aiming to inflict a new set of sanctions will trigger Kremlin’s overwhelming response. Moreover, such a strategy does nothing than reinforce the current regime’s credibility in Russian citizens’ eyes. A new “Iron Curtain” will not be of any use to the EU nor Ukraine.

Focus: OpenLux

Organised Crime and Corruption Reporting Project unleashed its weapons against Luxembourg, a small European country with 650 thousand residents. An ongoing OCCRP investigation called “OpenLux” unravels a massive network of companies based in the Grand Duchy, related to controversial figures including members of the Sicilian Mafia, ‘Ndrangheta, Russian oligarchy and far-right political parties. OpenLux points out current loopholes and transparency gaps in Grand Duchy’s legal framework allowing criminals to register and control companies in this jurisdiction. What will be the next step in OpenLux?

The non-governmental agency will most likely tackle Luxembourg’s flourishing financial system and list red-flags in Luxembourgish banks.

To be continued…

Malta: No need for more law enforcement

Edward Scicluna, the former Maltese finance minister, announced in 2019 the creation of brand new agency focused on combating financial crime. Such an agency would have a lot of things on its plate. Malta is an off-shore jurisdiction, harbours many online gambling firms, sports betting website and cryptocurrency business. All these are presenting high exposure to financial crime risk. Nevertheless, Scicluna’s successor announced last week that the plans to set up this agency had been cancelled.

Word on the street: Who are the Corsicans?

We have all heard of the Teflon Dons from the New York mob families. We have all witnessed the Sicilian Mafia’s downfall, and we are following the maxi-trial of the Calabrian ‘Ndragheta. Yet, we do not know not many things about Corsican organised crime. Why? Most likely because the Isle of beauty harbours Europe’s last criminal organisation that did not break its seal of secrecy.

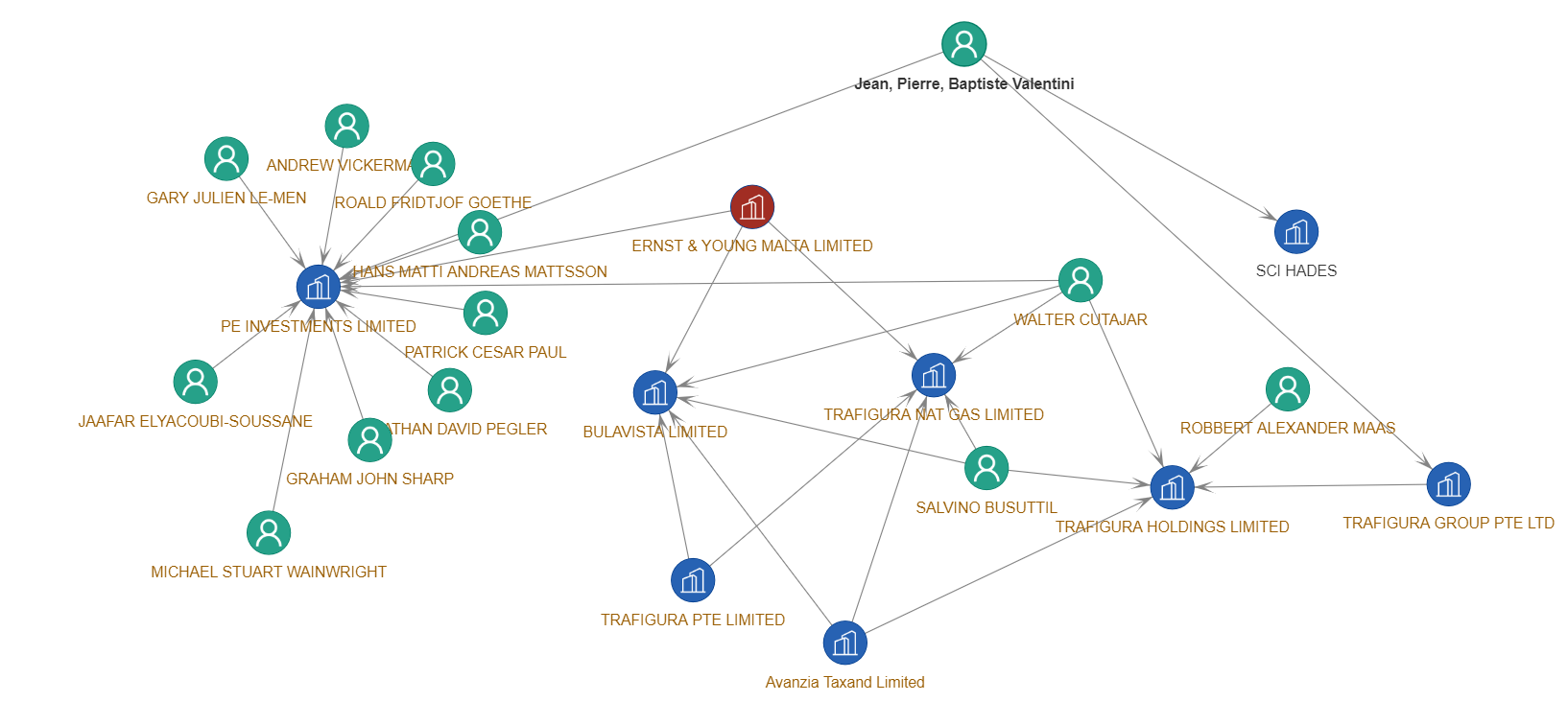

Jean-Pierre Valentini, a prominent Corsican businessman, was arrested in Marsilia for money laundering in relation to a gang of the Corsican milieu called “Petit Bar”. Valentini was a senior director with Trafigura, a leading commodity trading company and represented the firm’s interests in Africa. He left France for tax purposes and resided in Switzerland and Dubai but kept interests in the isle.

Valentini has a relevant history with law enforcement. He was arrested in September 2006 in relation to the alleged dumping of toxic waste from a cargo ship operated by Trafigura, in Abidjan, Ivory Coast. In 2017 an investigation revealed that Valentini backed an obscure real-estate deal togheter with Stéphanie Fileppeddu and Antony Perrino. Perrino is one of Corsica’s wealthiest entrepreneurs. Through Perrino, Valenitni had allegedly been in contact with Mickael Ettori, the “Petit bar” gang’s infamous leader. Currently, Ettori is a fugitive, hiding from the French justice. Valenitni and Perrino had allegedly helped the Corsican milieu to launder criminal proceeds through luxury real-estate investments.