Central banks have printed amid the pandemic outbreak unprecedented amounts of money, to avoid at least in the short-term a generalized economic collapse. Financial criminals perceive cash as a store of value. But in the current context, fiat money presents more inconveniences than advantages, especially when it needs to be laundered. The banking system is trying to move away from physical cash and financial crime feels the urge to move away from traditional banks. What avenues are available to launder illicit gains outside the traditional financial system?

Trade-Based Money Laundering (TBML) is a recent trend in money laundering aiming to circumvent the conventional banking system. TBML involves the import and export of goods and services and leverages the opportunities offered by international trade finance. While traditional money laundering uses bank transfers to dissimulate the origin of illegal proceeds, TBML employs trades. Thus, criminals do not transfer the value of their crimes through monetary transactions, but through merchant trades, like sending merchandise to a counterparty.

Moreover, laundering funds exclusively through the traditional banking system became overly complex. For instance, the US extraterritoriality laws pushed European banks to turn down transfers that may have even a minor relation with a counterparty related to a sanctioned entity. BNP Paribas, the leading French bank paid one of the biggest fines in history for breaching Iranian sanctions imposed by the United States.

TBML has all the advantages to become the main instrument for laundering illicit funds. Since the beginning of the coronavirus crisis the money supply (M2) in the United States increased from 15.5 trillion in March 2020 to 19.4 USD trillion in January 2021, while in the Eurozone from 12,4 trillion euro to 13,8 trillion euros throughout the same period. Therefore, criminals may have less incentive to hold value in cash, due to fears of inflation and the risk of money becoming a stranded instrument.

With TBML criminals aim to bypass banks, but it does not mean that financial institutions have no skin in this game. In the current economic context characterized by low-interest rates, trade finance is one of the leading lucrative activities for financial institutions. Banks are financing the cross-border trades via various products encompassing letters of credit, lending or export credit. Moreover, banks finance also shipping and freight, which are fundamental underlying drivers for trade finance. While leading financial institutions may not be directly involved in a cross-border trade finance deal when looking deeper into the underlying connections the name of a big bank could appear.

One should not ignore the fact neobanks, fintechs and payment platforms are rapidly increasing their presence in the sphere of commercial cross border payments, thereby constituting a serious alternative for criminals looking for alternatives to traditional banks. Together, fintechs and international trade finance are ideal tools for laundering money and staying under the radar of law enforcement. Most fintechs have insufficient AML systems and can be easily exploited by experienced launderers.

“You get to a point where it gets very complex, where you have money laundering activities, drug-related activities, and terrorist support activities converging at certain points and becoming one.”

Sibel Edmonds, American journalists

Focus: Danish tax money channelled to Iran

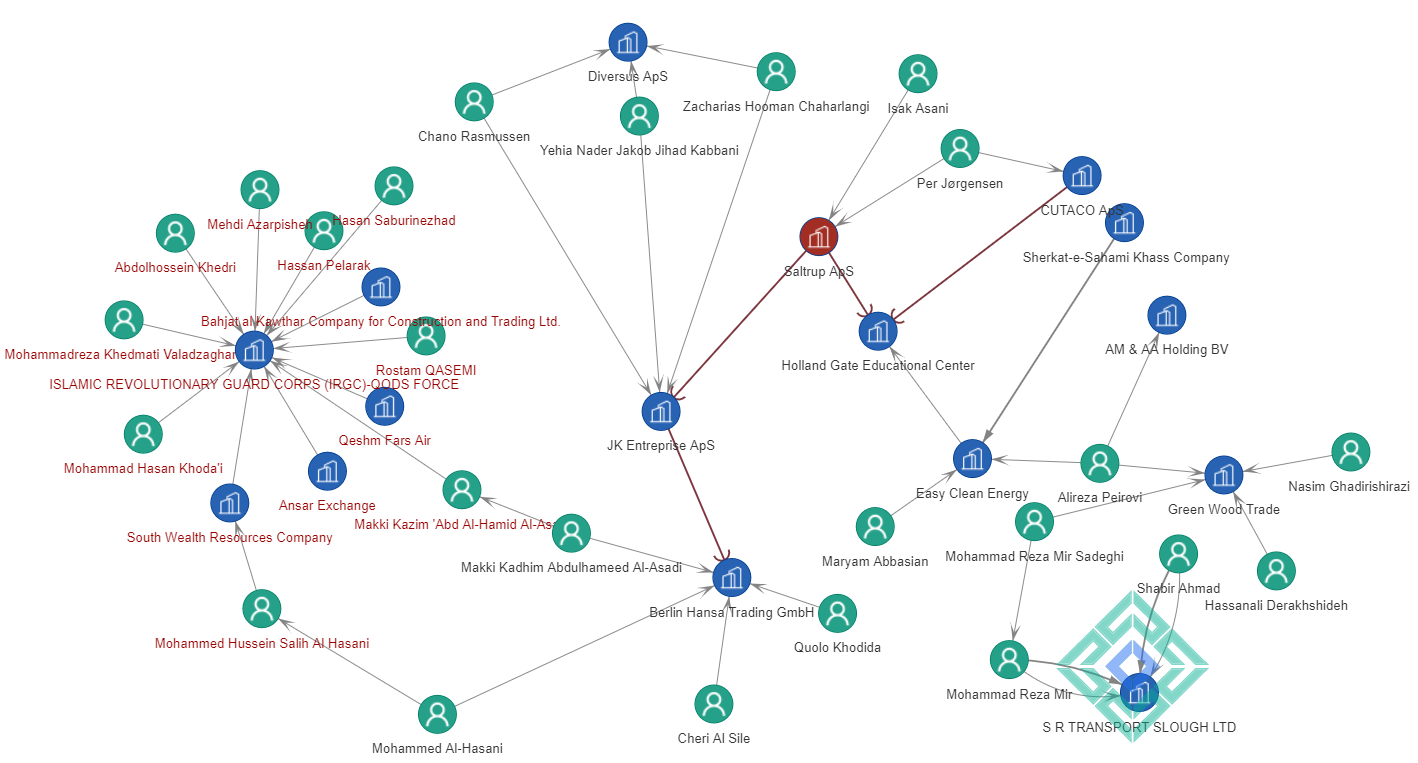

A joint investigation led by the German team of Business Insider and by the Danish newspaper Jyllands-Posten unravelled another massive case of terrorism financing in relation to VAT fraud.

In the centre of this investigation stands Berlin Hansa Trading, a German company with two directors figuring on the OFAC sanctions lists. Mohammed el-Hassani and Makki al-Assadi have been flagged as related to the Iranian Revolutionary Guard Corps, an organisation designated as terrorist. Berlin Hansa Trading had several ties with Iran but also with Danish companies that defrauded the Nordic country of 300 million Danish krone in unpaid VAT and company tax.

Saltrup ApS and JK Enterprise are two Danish companies involved in this scheme. They sent money to the German firm but also to a Dutch company called Holland Gate Educational Center. Holland Gate shares the same address in Holland as Easy Clean Energy

Easy Clean Energy is a subsidiary of an Iranian Firm Sherkat-e-Sahami Khass company, having as directors: Maryam Abbasian and Alireza Peirovi both Iranians citizens.

TBML and VAT fraud are a deadly combination because the last step in a VAT carousel corresponds to the step where proceeds are laundered and transferred in another jurisdiction as merchandise. Both TBML and VAT fraud aim for goods with low volume and high value. In its case, fraudsters dealt perfumes and fragrances.

Focus: Fowler Oldfield

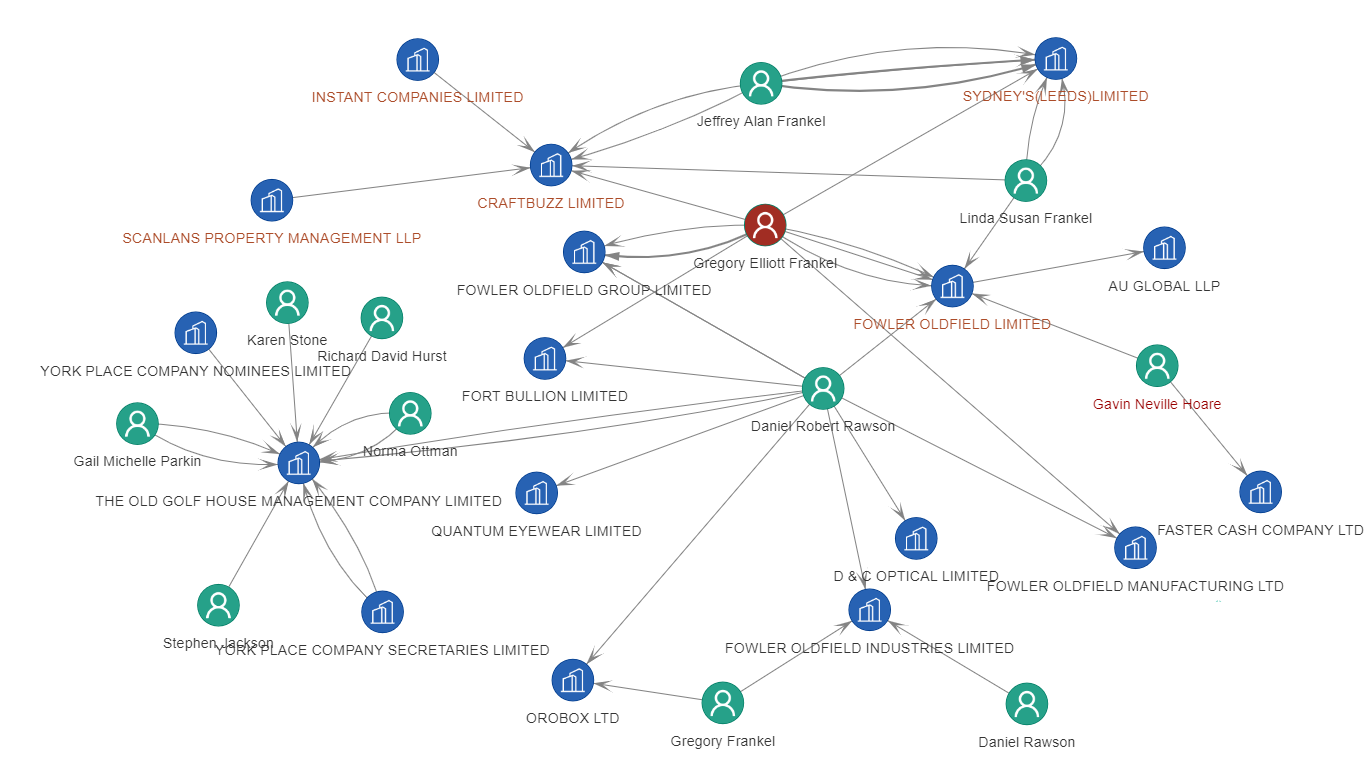

The Financial Conduct Authority, the British financial watchdog pointed at Natwest, a subsidiary of Royal Bank of Scotland for insufficient anti-money-laundering processes. The banks handled cash deposits accounting for 400 million pounds made by Fowler Oldfield between November 2011 and October 2016. Fowler Oldfield is a Bradford-based gold dealer and jeweller liquidated after a police raid in 2016.

A few things were not looking right with Fowler Oldfield’s directors. In the British business registry at least two persons with significant control including Gregory Frankel appear with different dates of birth in different instances.

Word on the street: “The Shark”- a new gang leader in Mexico

If we believe a recent investigation led by a consortium of international journalists, it looks like foreign organised crime is moving in Mexican cartels” domestic turf. According to the newspaper Milenio, a Romanian mafia led by Florian “The Shark” Tudor has serious operations in Mexico including cloning of bank cards, hacking of ATMs and money laundering activities. “The Shark”’s gang with the help of Mexican bankers and Venezuelenas hackers managed to pocket hundreds of millions of dollars through credit card fraud.

If we believe this story, Romanian criminals who are not even a pale competition in Europe for Albanians and other groups, are hustling on Cartels’ territory.

The story seems like another pulled by the hair piece of sensationalism.