The COVID-19 pandemic has not only changed human interactions but also people’s behaviour concerning investment. One of the unforeseen consequences of the pandemic outbreak is a massive inflow of liquidity from retail investors into traditional and alternative investments. Over the past year, a plethora of digital platforms has arisen proposing to unsophisticated members of the public various investment opportunities, including shares, peer-2-peer loans, real estate, private equity or non-fungible token. Are all these new instruments genuine? Are we dealing with an epidemic of digital Ponzi schemes?

A top-down analysis of the situation shows that genuine alpha-generating investment opportunities are scarce and accessible to a very limited and select circle of informed sophisticated investors in a global economic recession. So, what is left for the big majority of the individuals that joined the retail-investing frenzy?

Désillusion.

When investors make irrational decisions, there is always somebody extracting profits from their erratic behaviour. Therefore, many digital investment platforms exploiting individuals’ unrealistic appetite for unqualified risk are nothing more than glorified Ponzi schemes.

Ponzi schemes have a few common features that can be assessed qualitatively through the due-diligence process.

An investment that is part of a Ponzi scheme is usually unregulated and is generally presented to potential customers as a high yield instrument but with a guaranteed return. High yield returns are often associated with high risk. Therefore, if such an investment is promoted as bearing less or no risk, it should trigger a red flag.

As revealed in the Maddoff case, Ponzi schemes present to investors regular, positive returns with low corelation to fundamentals regardless of overall market conditions. Investment returns, especially high yield instruments do exhibit big fluctuations and are not regular. If an investment platform reports a smooth time series of returns then this is a serious warning signal.

Promoters of Ponzi schemes maintain a secretive and mysterious aura and generally do not disclose the strategies generating the guaranteed returns. The companies promoting this type of investment run in a close circuit, meaning that there are fewer or no independent auditors or custodians. The scammers do ensure the end to end process.

What about investment platforms with a secondary market?

The trend amongst investment platforms is to offer their members access to secondary markets, thereby reducing the exposure to liquidity risk. Nevertheless, these secondary markets have sporadic trading volume and can be easily maniuatinf, thereby artificially increasing valuations and facilitating, in the long run, the development of a Ponzi scheme. Newer investors will buy from older ones, assets at inflated prices.

How things will unravel?

When rampant suspicions trigger alerts, investors would want to cashout their alleged gains . In such circumstances, brokers and salespersons will suddenly be difficult to reach, ask for heavy paperwork and try to encourage investors to "rollover" their positions.

The accelerated digitalisation of retail investing allows juxtaposing multi-level marketing over investment scams. Thus, a participant in a Ponzi scheme is incentivised to recruit new members to boost the amount of harvested funds.

The uncertain global economic situation, the unprecedented money printing and the ease of access to investment constitute a fertile ground for Ponzi schemes.

“Even if they never got anything for it, it was cheap at that price. Without malice aforethought I had given them the best show that was ever staged in their territory since the landing of the Pilgrims! It was easily worth fifteen million bucks to watch me put the thing over.”

Charles Ponzi, Italian businessman and con artist

Focus: Agri Gold

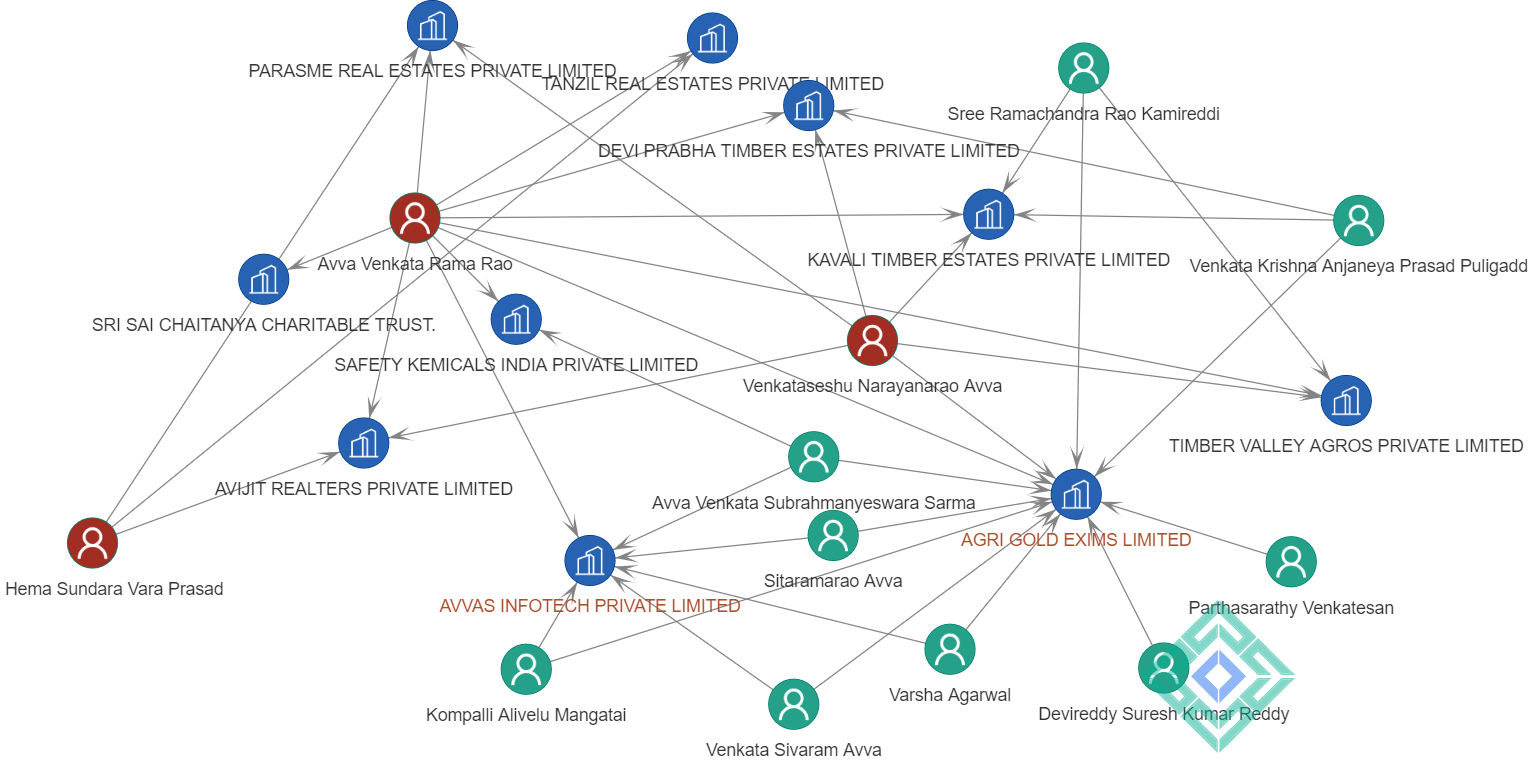

A classic example of Ponzi scheme was dismantled last year in India. The company was Agro Gold Group. Indian law enforcement arrested three individuals Avva Venkata Rama Rao, Avva VenkataSeshu NarayanaRao, Avva Hema Sundara Vara Prasad, who organised the scam that defrauded around 900 million USD from investors. Agro Gold aimed to develop affordable farmlands. The investment scam consisted of 150 companies collecting funds from individual investors across the country with a guaranteed high rate return.

The innovative twist of this fraud was that the investments were backed by real-estate, but when the scam dwindled, investors did not recover their deposits nor get the farmland.

Focus: Petro Poroshenko

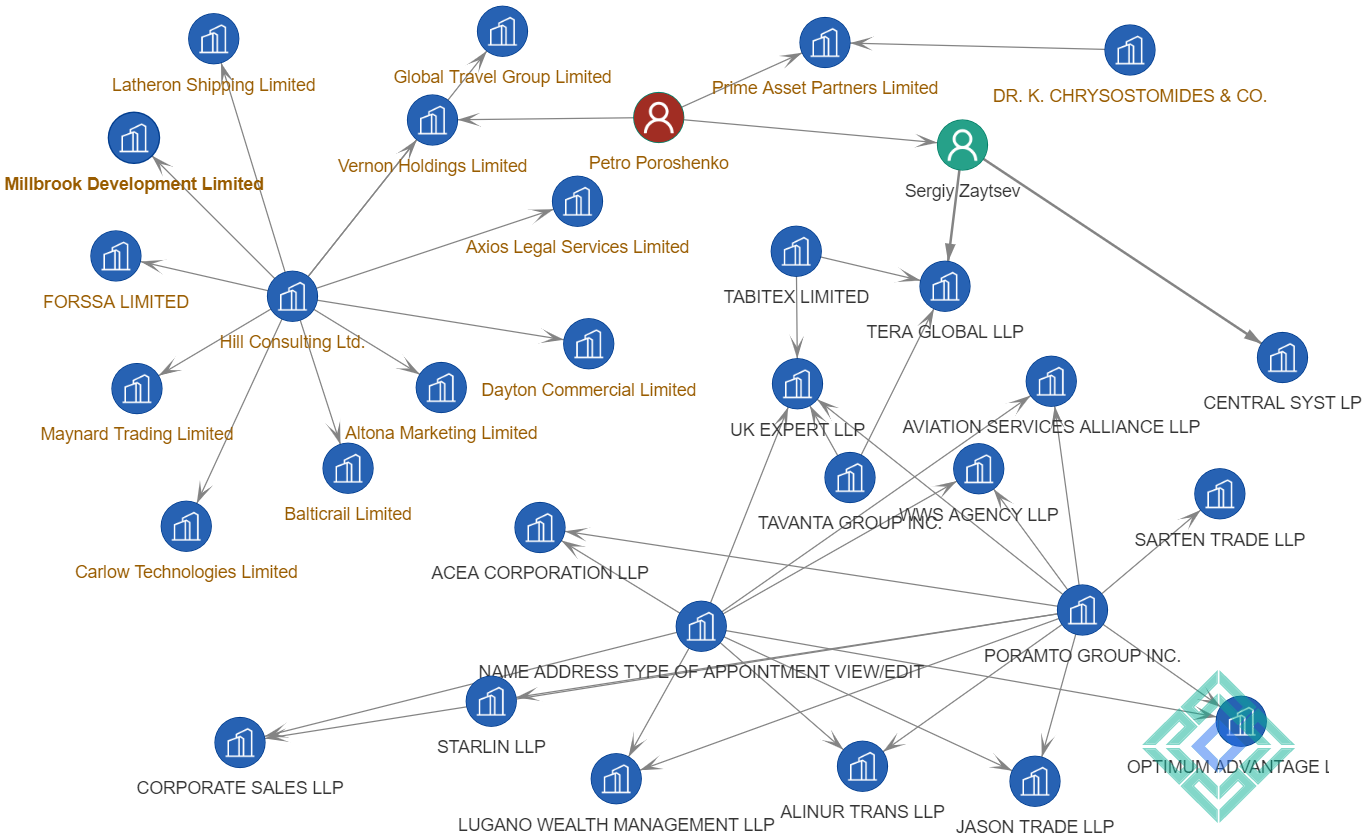

After the 2014 Maidan, Poroshenko was perceived as Ukraine’s saviour who will lead the ex-Soviet country towards European integration. Seven years later, the name of the former Ukrainian president appears in many investigations, including one led by the OCCRP showing that he controlled several offshore firms.

Besides Vernon Holdings, a firm based in Russia and the British Virgin Islands, Proposhenk controlled also a Cyprus based firm called Prime asset Partners that was managed by K. Chrystodmodes, a Cypriot law firm used also by many prominent Russian oligarchs, some of whom are under US sanctions list for their involvement in the Donbas conflcit.

Word on the street: Giuliani raided by Feds

Rudy Giuliani made his reputation throughout the 1980s as U.S. Attorney for the Southern District of New York. He played a key role in the federal prosecution of the New York five mafia families. The Federal Bureau of Investigation was his main ally in applying RICO to indict the key figures of the mob.

Times are changing, and currently, Giuliani is the object of a criminal investigation concerning his dealings in Ukraine. Last week F.B.I. agents executed search warrants around at Giuliani’s apartment on Madison Avenue and his Park Avenue office in Manhattan. The ongoing matter is connected to Donald Trump’s first impeachment.

The federal agents were specifically looking on his electronic devices for messages between him and several Ukrainian officials, including the former president, Petro Poroshenko, and two former prosecutors who had helped Giuliani glean data about Hunter Biden’s business in Ukraine.