Quantitative easing, money printing, COVID stimuli, economic help packages are just a few of the terms that made media's headlines since March. When the real economy stopped suddenly amid the coronavirus outbreak governments tried to avoid at all price the 2008 scenario. Therefore, policymakers decided to inject liquidity into financial markets to prevent a downward spiral in assets' valuations and to supply monetary help to the real economy. The schemes for helping the economy included zero interest rate loans, paid wages while on leave and unemployment benefits.

While those measures were critical in avoiding a massive dislocation of the economy, they also represented fertile ground for criminals and fraudsters. A virtually "free" source of monies attracted scammers that presented false claims. Moreover, given the urgency of the situation, governmental agencies did not have enough time to screen a massive amount of information correctly and to streamline the application process. Stimulus schemes were structural, and a significant number of firms were beneficiaries. Therefore, a review of the righteousness of the used funds at such a large scale has low feasibility. As such, a significant number of scammers may not answer for their acts.

The furlough scheme implemented in the United Kingdom has paid 80% of the wages of workers placed on leave since March, up to a maximum of 2,500 GBP a month. The package represented a cost of 35.4 billion GBP for the Exchequer.

HMRC’s representatives estimate that between 5% and 10% of the funds allocated in the furlough scheme, accounting for up to 3.5 billion GBP are in connection with wrongful or fraudulent claims.

“There is a gigantic difference between earning a great deal of money and being rich.”

Marlene Dietrich, Hollywood actress

Governmental COVID help for HNWI-owned companies

The main financial hubs, including the City and Wall Street, suffered amid the pandemic outbreak. Shortly after governments announced the first support packages for businesses, we heard that hedge funds managers applied for the Paycheck Protection Program in the US or the furlough scheme in the United Kingdom. The stimulus packages intended to aid small and medium enterprises and to avoid a high rate of defaults, which could ravage the real economy. Those programs aimed to provide monetary support to distressed business, which would not have been able to survive otherwise. Needless to say, the scope of application of those packages do not have a clear-cut definition. Therefore, many companies owned or managed by High Net Worth Individuals applied to receive public funds.

The big financial hubs attracted investors from all over the world that incorporated small firms in London, Delaware or New York to conduct business in those countries. Those firms would have qualified for PPP loans or similar aids. A simple example is that of West Virginia-headquartered United Coal Company which is since 2009 in the portfolio of a holding company called Metinvest. Metinvest is based in London and is controlled by Ukraine’s richest person, Rinat Leonidovich Akhmetov. He also owns several businesses in the UK, that could theoretically qualify for the furlough scheme.

The bottom line is that such programs are indeed helpful for HNWI-linked firms, but smaller firms with limited resources and volatile growth may be reluctant to take loans, they may not be able to reimburse.

ICICI Bank: A simple network, a complex case

The Enforcement Directorate, India's leading law enforcement agency arrested earlier this week Deepak Kochhar, husband of former ICICI Bank CEO Chanda Kochhar, in a money-laundering matter.

Chanda Kochhar headed ICICI Bank's activity until 2018. The matter of money laundering is in connection with Videocon Industries, an Indian company based in Aurangabad. There are several connections between Videocon and the Kochhars.

Venugopal Nandlal Dhoot, Videocon's latest director, is also a stakeholder in NuPower Renewable, a company controlled by Deepak Kochhar. Moreover, another Videocon director, Ajay Saraf, is also heading the investment securities activities of ICICI's Banks, incorporated as ICICI Securities. Chanda Kochhar also served as director of that firm.

Assessing the extended network of key managing directors in a corporate and the potential risks should be a high priority for the compliance managers to avoid future adverse developments.

Cyprus Papers: Passport for oligarchs

Al Jazeera's Investigative Unit published a set of documents revealing the identity of several high-profile figures that acceded to the Cypriote passport over the recent years.

It is not a secret that Cyprus was fiscally attractive for holding companies. Thus, many individuals that controlled multiple businesses across the world opted to incorporate managing companies in Venus's isle. For example, several Russian oligarchs moved their holding firms in Cyprus since the late 2000s. The island provided a significant advantage for Russian political figure or public employees, which were not supposed to be involved in private businesses.

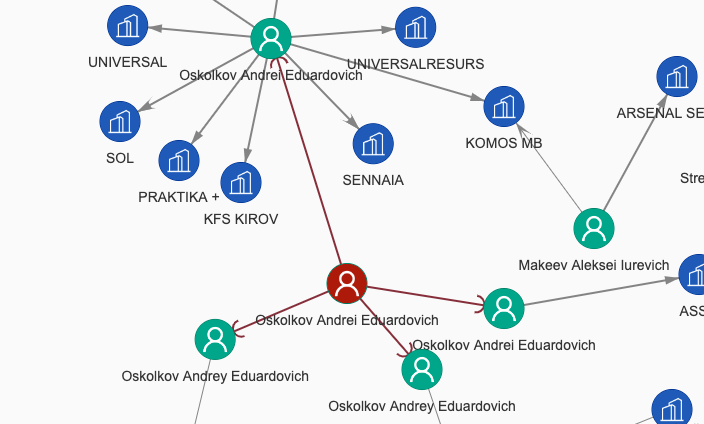

It is the case of Andrey Eduardovich Oskolkov (DOB: 4/02/1994), who served as a deputy in the council of the Udmurt Republic, a territory of the Russian Federation. He is a stakeholder in several Russian entities including the Komos group. He also appears as a director in several offshore companies based in the United Arab Emirates, Panama and Seychelles. The Cypriot passport is just a small piece of the puzzle built around Oskolkov, one of Russia's best-remunerated politicians.

Word on the street: Life prison for mob underboss

Steven Lorenzo Crea aka Wonder Boy (DOB: 18/07/1947) was sentenced earlier this month to life imprisonment. Crea was for over a decade the underboss of the infamous Lucchese syndicate, one of New York's "Five Families". He raised to power in the organisation during the 1980s, when he played a crucial role in extorting many trade unions and collecting protection taxes from various enterprises. The Lucchese family took massive hits from law enforcement and is in a state of advanced attrition with a decreasing street presence.