Special Purpose Acquisition Companies known as SPACs became one of the most popular investments amid the pandemic. While a record number of SPACs were listed over the past year, the risks related to such investments are ignored. Besides the fact that the potential price fluctuations can be significant, SPACs are opaque and phantomatic vehicles. What are the hidden dangers behind SPACs?

Mergers and acquisitions(M&A) were for many decades the bread and butter of Wall Street bankers. Traditional avenues for financing mergers and acquisitions include: paying in cash, structured debt, new shares issuance, bond issuance and exchanging stocks. The M&A industry is mature and well organized. Financing M&A deals is one of the main revenue streams of leading investment banks. There are several downsides to traditional M&As. First, the financing is backwards-looking and takes place once the parties agree upon the term sheet of a deal. Second, when financed by debt instruments, M&As expose the lenders to significant credit risk, which is heavily priced in terms of prudential capital by the Basel regulation. Last, but not least, the potential gains for the bankers are very limited once a deal is executed.

SPAC originated in the late 1990s as an innovative tool aiming to revolutionise the world of corporate acquisitions. SPACs are non-operating entities that have a unique goal to raise capital through an initial public offering (IPO) for the purpose of acquiring existing companies. The money serves for well-defined acquisitions or the intention of potentially buying an operating business within a specified period of time, cca. two years. Thus, an investor has very little information about the assets controlled by that SPAC or the beneficial owners of the acquired businesses.

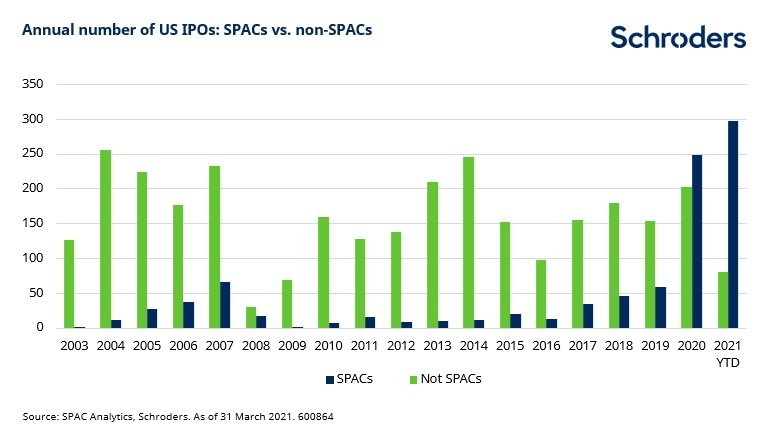

The pandemic brought several disruptions in the world of investment. Dematerialised reality, quantitative easing and retail investors’ frenzy are only a few of the ingredients that contributed to SPACs’ rampant popularity. SPACs are in fact cannibalising the traditional IPO market. According to Schreoders, a leading investment manager, over the last year, SPACs accounted for 79% of IPOs by number and 69% by value.

SPACs are nothing more than glorified shell companies, being also known as “blank check companies” and “cash boxes”. If investing in a stock is similar to betting on a horse in a given horsing race, investing in a SPAC is the same as betting on the fact that another punter will put the right bet on the winning horse in a race which is not yet known.

What makes SPAC special? SPAC or PSAC?

Investing in SPAC bears obvious market risks. But, the real problem with SPACs is that the investor buys shares in an empty shell and has no say on the final destination of funds. A SPAC can merge or acquire companies from various walks of life, having different levels of transparency. The due diligence process in a traditional IPO is very thorough, thereby conferring to investors some level of comfort with regards to the company's assets.

In the case of a SPAC, a governmental Chinese company could merge with a Russian startup financed by a sanctioned individual or with an online gambling firm involved in bet fixing.

While a SPAC is governed by the regulations of the country of listing, the underlying companies that will make the object of M&As could be rogue and expose the investors to unforeseen financial crime risks.

This is why SPACs are special. SPACs should be called PSACs (Purposely Special Acquisition Companies).

Money raised through a SPAC can end in the hands of unscrupulous individuals or criminal organisations. SPACs are perfect tools for laundering funds at a global level and for legitimising criminal enterprises. There is no better way to conceal the proceeds of economic crime than capital markets. Not only that it offers the perfect way for rinsing funds , but also brings credibility to a dodgy company.

“Productive assets such as farms, real estate and, yes, business ownership produce wealth – lots of it. Most owners of such properties will be rewarded.”

Warren Buffet, American investor

Focus: WeWork

We work and investors dream. WeWork was aiming to revolutionise the way people and companies work by proposing flexible workspaces, agile services, and leading technologies to move business across the world. Wework’s planned revolution had fully succeeded amid the pandemic outbreak. People realized that homes are flexible workspaces and there is no need for overpriced co-working space.

So, what is Adam Neumann’s value proposition? Empty buildings… But the show must go on even after WeWork’s controversial founder left the venture with several billion wisely extracted from investors. What better way to take empty buildings to the next level in the world of business than empty shell companies?

WeWork has agreed in March to go public via a SPAC merger with the BowX Acquisition Corp. The deal comes two years after a failed IPO and values the firm at 9 USD billion, less than a quarter of its 2019 valuation. Seemingly, such a SPAC deal is nothing more than a recipe for disaster.

Focus: DraftKings

SPACs are non-operational entities, which acquire over time other companies and businesses. When investors buy SPAC shares they have no clear idea about the entities that will merge.

The assets behind a SPAC can be opaque and sometimes doggy. It is the case of DraftKings, according to Hindenburg Research a world-class shorter;

DraftKings is a leading American daily fantasy sports contest and sports betting operator. The company got listed on NASDAQ following a merger between DraftKings, its SPAC sponsor, and a Bulgaria-based gaming technology company called SBTech. The problem is that the profit comes mainly from the Bulgarian firm. SBTech accounted for 25% of total revenue at the SPAC consolidated level and was the only firm bringing money into the deal. SBTech’s turnover seems to come from black markets, as the Bulgarian betting company is active in multiple countries where gambling is banned.

Word on the street: Knights of Cocaine V

Toronto police announced earlier this week its largest-ever international drug takedown. Canadian law enforcement arrested 20 suspects and captured over 1000 kg of drugs in a transnational operation called “Project Brisa”.

Drugs including cocaine, crystal meth and pot originated in Mexico and were transported to Canada through California. The smugglers were using modified tractor-trailers with hidden compartments. The investigation showed that the drugs were shipped for more than one year and was made possible by the installation of hydraulic traps in tractor-trailers, thereby being non-detectable even by X-rays scans. Such modification made it possible to smuggle over 100 kilograms in a single transport.