The Financial Conduct Authority, Britain’s financial regulator issued a consumer warning on Binance Markets Limited and the Binance Group. Binance, one of the world’s largest cryptocurrency exchanges was forced to stop all regulated activity in Great Britain because it failed to meet FCA’s anti-money laundering rules. What does this entail for crypto firms?

Following Binance’s ban in the United Kingdom, many crypto firms abandoned their licence applications with the British regulator looking for friendlier jurisdictions. Cryptocurrencies seemed to go mainstream and to become a fully-fledged regulated alternative investment.

So, why do regulators around the world crackdown on the cryptocurrency market?

Crypto-currencies are a subset of digital currencies that appeared in the late 1990s with the rise of the internet. By the end of the 2000s, almost all digital currencies platforms were shut down by law enforcement for facilitating money laundering.

In a testimonial published in 2013, the digital currency expert and white-hat hacker Fyodor Yarochkin, underlined that the digital currency phenomenon and its ties with organized crime are more serious than one would imagine. He mentioned that for a fee of 9% of the nominal amount, criminal proceedings could be materialized in liquid cash through digital currencies.

Crypto-currencies inherit this image from their predecessors.

Therefore, since its inception Bitcoin was associated with the massive risk of money laundering. What made Bitcoin and some Altcoins unique for money launderers is the fact crypto-currencies can be used in all three phases of the laundering process: placement, layering and integration. Bitcoin can be used as payment for illegal activities or items or in exchange for illegal funds, thereby being a tool in the placement stage.

In its early years, Bitcoin has been reportedly used on Sheep Marketplace, the underground service that replaced the defunct Silk Road, a website processing trades for drugs and other illegal goods.

In the early days, crypto-currencies could move “anonymously” (or almost anonymously) from one wallet to another and from one jurisdiction to another. Therefore, the layering step was one of the main use of crypto-currencies in laundering funds.

Nevertheless, Bitcoin leaves a visible trail of transactions on its underlying blockchain. Several companies including Elliptic, Coinfirm, CipherTrace, Chainalysis, BlockSeer, Xapo, BitGo and Gresham International developed bespoke AML/ KYC solutions for checking and monitoring cryptocurrency transactions. In the case of Bitcoin, the task is straightforward with all the information being available in the decentralised public ledger.

With the deployment of KYC processes in the crypto-currencies exchanges the anonymity of the transaction is partially or entirely lost. After the first crypto-exchanges introduced identity screening for their traders, the crypto-community divided into two parties:

- A first-party supported the increase in transparency and regulation of crypto-currencies. This party saw in regulation and transparency an avenue for the crypto-currency to become a regular asset class, thereby attracting a huge inflow of funds from “Wall Street”.

- A second party saw in this trend a real threat of losing the privacy and the anonymity of the crypto-universe. And in their view, the anonymity based on crypto-currencies transactions preserves the “democracy” in the crypto-universe, the final goal of crypto-currencies being that of bypassing Wall Street, central banks and governments.

The innovation in the crypto-universe especially in the world of cryptocurrencies is driven by the second party. Anonymity was the initial Bitcoin’s “raison d’etre”. In order to ensure anonymity a few solutions appeared over time:

- Crypto-currencies Mixers/tumblers

- Decentralised exchanges

- Crypto-flipping

Monero has become the leading niche “privacy coin” because it was designed to obscure the sender and receiver, as well as the amount exchanged. The solutions built to keep the anonymity of crypto-transactions revolve around coins like Monero.

Mixers/tumblers

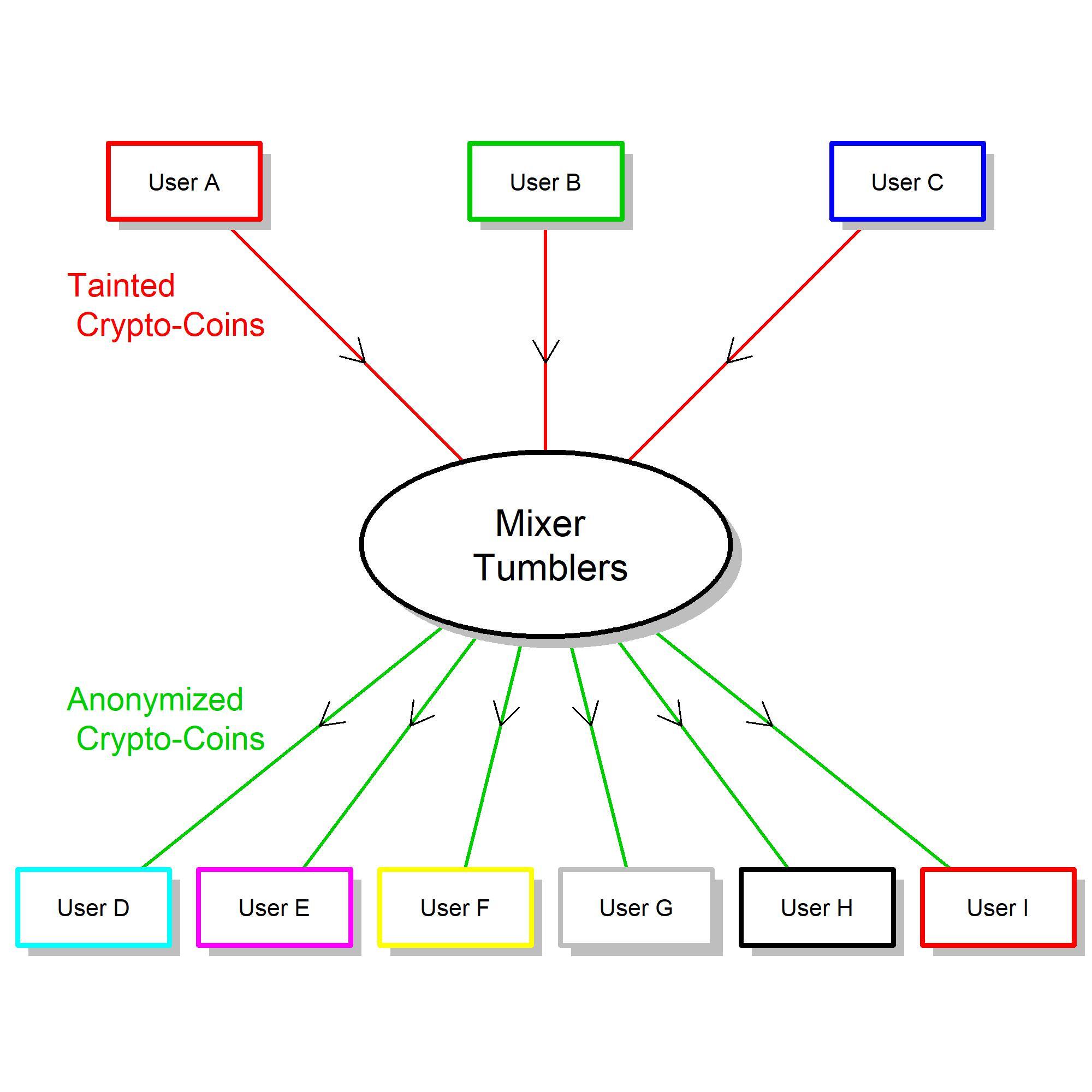

One of the first solutions to guaranteeing privacy in the crypto-universe were the mixers or tumblers. Crypto-mixing or crypto-tumbling (known as Bitcoin mixing or Bitcoin tumbling in the case of Bitcoin) is a method that employs a third party called a mixer to break the connection between the sender and the receiver of crypt-currencies. This is achieved by interposing layers between the sending address and the receiving address of crypto-currency. Crypt-mixing is very similar in nature to the layering step in classic money laundering schemes, thereby being named in some instances crypto-laundering.

In the figure below, users A, B and C send tainted crypto-currencies (Bitcoins) which can be traced by the exchange. Senders (users A to C) are identifiable. The mixer cuts all links between the receivers (Users D to I) and the senders (A to C). A simple parallel would be that with hallmarked physical gold coins. The mixer takes those hallmarked coins, melts them and issues new un-marked coins.

Mixing is a crucial service for those who use cryptocurrencies for illegal trades especially on Dark-net Markets. Tax evaders would also need these services in order to keep their profile anonymous. The main providers of mixing services for Bitcoin transactions are Coinmixer.se; Helix; Bitcoin Blender; BitMixer.io. The fees charged by mixers providers range between 0.5 and 3 % of the transferred amount, the lowest fees being offered by Blockchain.info for only 0.5%. The processing time varies from a few minutes to 24 hours.

The main issue with mixing/tumbling is that the process depends on a third party, thereby generating additional risks including the likelihood of theft, hacking or snitching to law enforcement.

Decentralized exchanges

Mixing/tumbling is a service aimed to erase the traces of Bitcoin/Altcoin transactions handled over crypto-exchanges. An exchange is in fact a third party between the various traders of crypto-currencies. Exchanges do not only break the anonymity of the transactions but also expose the clients to operational and counterparty risks. The fall of Mt.Gox in 2014 is a relevant case of the risk faced by every user of a crypto-exchange.

An efficient alternative came with the so-called decentralized exchanges, whereas transactions do not rely on a third party like they do in the case of centralized exchanges. Transactions take place directly between the users using a peer-to-peer automatized process. The main advantage of decentralized exchanges over centralized exchanges is the fact that users do not need to deposit funds with the exchange's custodian. A direct consequence of the fact that these exchanges are based on a peer-to-peer approach is an increased level of privacy and anonymity of the transaction. Examples of decentralized exchanges are Bitsquare, Waves Dex, Openledger Dex… Decentralized exchanges are still at the beginning of the journey and more developments are expected in this field. Low liquidity is currently one of the big drawbacks of decentralized exchanges.

Crypto-flipping

Concealing the path of Bitcoin transactions can be achieved thoroughly by swapping Bitcoin with other cryptocurrencies, the most used being Monero. The transfer of Bitcoins between a sender and a receiver includes a step where the bitcoin is exchanged in Monero and afterwards Monero is exchanged back into Bitcoin before arriving at the receiver. The level of complexity of crypto-flipping can be increased when the intermediary step involves few crypto-currencies other than Monero.

Exchanges like Binance are connected to platforms providing the solutions described above. It triggered regulators’ crackdown on crypto firms.

“In its current version, in spite of the hype, bitcoin failed to satisfy the notion of “currency without government" (it proved to not even be a currency at all), can be neither a short or long term store of value (its expected value is no higher than 0), cannot operate as a reliable inflation hedge, and, worst of all, does not constitute, not even remotely, a tail protection vehicle for catastrophic episodes.”

Nassim Taleb, Black Swan author.

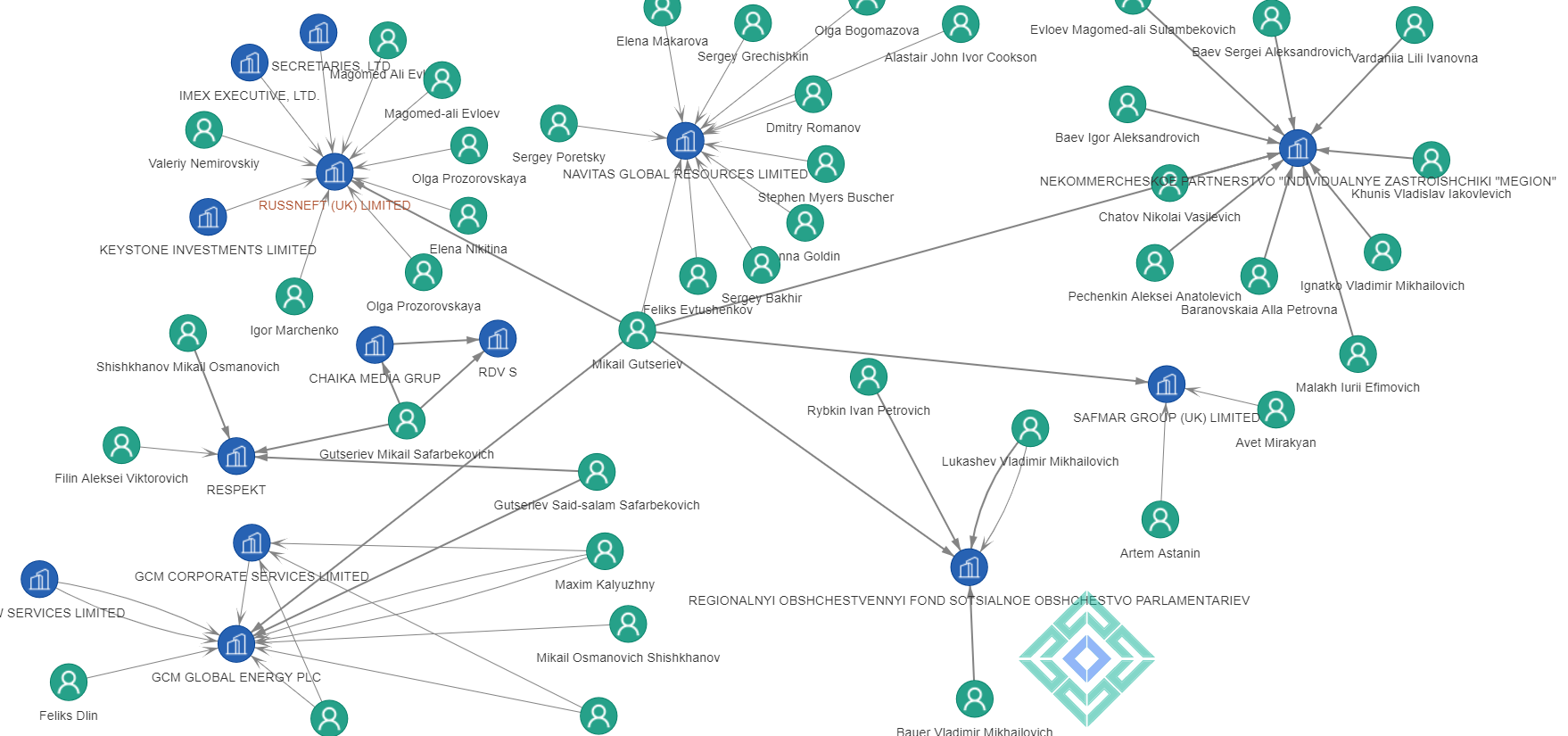

Sanctions: Mikhail Gutseriev

The European Union updated its sanctions list in relation to Lukashenko’s regime. Mikhail Gutseriev, A Russian oligarch of Ingush origin is named on the EU’s list, due to his close relationship with the Belarusian dictator. Nevertheless, Gutseriev doesn't appear on the United Kingdom's sanctions list.

Gutseriev’s son Said is a politically exposed person, being elected in the Russian Duma. Moreover, Gutseriev controlled serval companies in the United Kingdom, among which we can note Russneft UK along with a few companies in Moscow in the energy business.

Word on the street: Knights of Cocaine VI

Dutch police informed the Associated Press about a capture of nearly three tons of cocaine and 11.3 million euros in cash in a raid on a private ranch near Amsterdam. The drug seizure is one of the biggest ever by detectives in the Dutch capital. The cocaine has an estimated street value of 195 million euros. It was piled up in tightly wrapped blocks throughout the building about 20 kilometres south of Amsterdam and in vehicles. The Dutch police have arrested two men, ages 54 and 29 and have also recovered six guns, silencers, ammunition as well as luxury items and money counting machines. The provenance of the cocaine was of South American provenience and was smuggled through one of the main European ports

Rotterdam, Antwerpen and Hamburg are the key entry points of South American cocaine in Europe. The recreational drug is transported along with legal merchandise over the Atlantic.