Panama Papers, Paradise Papers, Cyprus Paper, FinCEN leaks… Since 2016, a wave of confidential documents from banks and law firms were made available to the public by various media. Journalists’ investigations point the finger at banks, for accepting to deal with criminals, dictators, and fraudsters. Whilst disclosing such information may raise the awareness about financial crime, in the long-term it may do more harm than good. So, who are the primary beneficiaries of these leaks?

Since Lehman’s default, members of the public learned that the financial system works for the rich. So, for a layperson, such information does not bring anything new. Prosecutors and law enforcement agencies have an extended “Who is Who” of the financial crime underworld and the leaks bring rarely new names. Serious organized crime groups involved in activities like tax evasion and money laundering gather from these leaks significant intelligence. They know where the banks are in their risk assessments and how deep an institution manages to dig into a doubtful profile. Leaked information about Suspicious Activity Reports (SAR) exhibit the strengths and the weaknesses of the bank’s processes.

Publicizing private documents may serve in the short term to bolster the attention towards several media platforms. Nevertheless, in the long-term, such information reinforces the position of serious organized crime groups that will be able to use this intelligence to their advantage.

Tackling financial crime is not a blitzkrieg that can be won with media articles. It is a long war of attrition that need to be fought by professionals that have the tools and the legal means. The FBI required more than three decades to dismantle the five New York-based criminal families. It was a long process that requested many efforts and a deep understanding of criminal organizations. Tackling the financial crime pandemic needs to start with identifying and studying the main criminal groups that operate at a global level. Disclosing non-public information about the internal risk management process of an institution does not help and could potentially hamper its efforts to tackle financial crime.

“I sincerely believe that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.”

Thomas Jefferson

Sanctions: Evrofinance-Mosnarbank

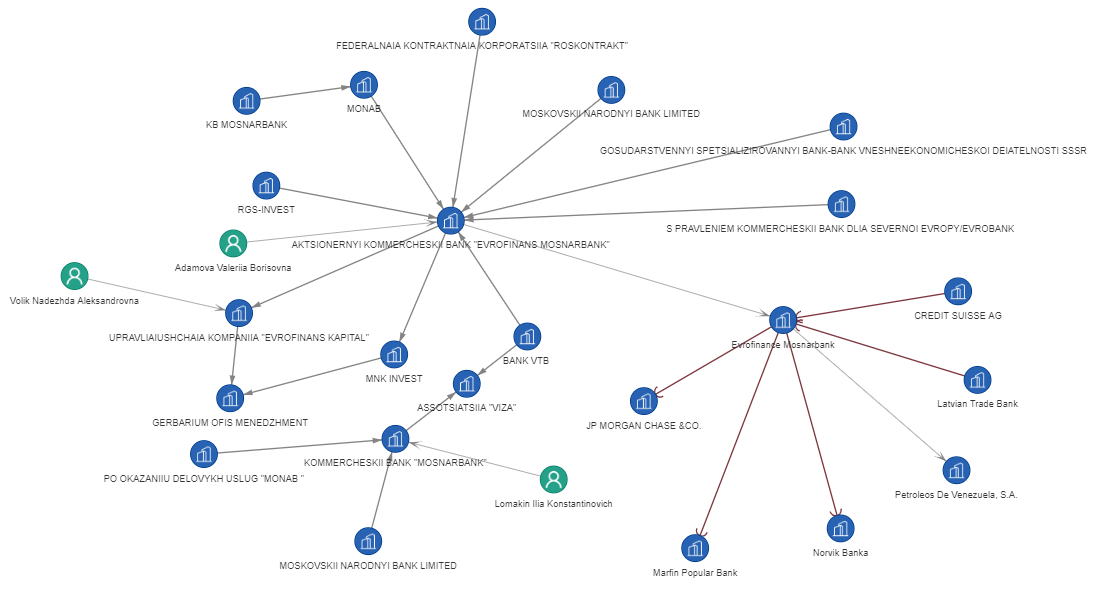

Evrofinance-Mosnarbank is one to the few Russian banks under OFAC sanctions. Before becoming undesirable, the institution operated suspicious transactions with several reputed banks including Credit Suisse and JP Morgan as revealed by FinCEN leaks. The Moscow based bank is owned by a consortium of big companies, one of them being VTB Bank.

The Russian banking sector encompasses over 2,000 institutions, and Evrofinance is not a prominent one. Some other Russian banks appear in the FinCEN leaks, so we could expect in the near future to see them on the sanctions list.

Focus: ABLV Bank

ABLV Bank was until recently the most significant private bank in the Baltic region. The Riga based company entered the process of voluntary liquidation in 2018 after getting sanctioned by the US Department of Treasury for money laundering.

FinCEN leaks show that between 2014 and 2016, ABLV received suspect funds for a total amount of 130 million USD. Amongst the banks that operated the transactions, we find the now-defunct Mediterranean Bank, but also reputed institutions. Kazakh and Russian banks conducted the biggest transactions. Seemingly, ABLV was not carrying these activities on a standalone basis, and other partners were aware of the situation.

| Period end date | Name of originator bank | Country | Amount (USD) |

|---|---|---|---|

| Oct-14 | Halyk Savings Bank Kazakhstan | Kazakhstan | 31,273,598.00 |

| Dec-16 | ING Belgium Brussels | Switzerland | 21,702,789.70 |

| Oct-14 | Primorye Bank | Russia | 21,096,981.63 |

| Dec-16 | Rosbank OAO | Russia | 13,897,597.69 |

| Dec-16 | Royal Bank of Scotland P.L.C. | United Kingdom | 8,333,573.61 |

| Dec-16 | Canadian Imperial Bank of Commerce | Canada | 7,851,873.04 |

| Dec-16 | Banque De Commerce Et De Placements | Switzerland | 6,828,425.10 |

| Dec-16 | Societe Generale Zurich | Switzerland | 5,799,925.00 |

| Oct-14 | DBS Bank Ltd Singapore | Singapore | 4,950,000.00 |

| Nov-16 | HSBC Bank | Russia | 4,258,807.48 |

| Jun-15 | Barclays | United Arab Emirates | 2,070,030.43 |

| Jul-15 | T C Ziraat Bankasi AS | Turkey | 1,400,000.00 |

| Jul-14 | EFG Bank | Switzerland | 630,000.00 |

| Nov-15 | Kredobank | Ukraine | 258,841.41 |

| Mar-15 | Mediterranean Bank Plc | Malta | 4,780.00 |

| Total received funds | 130,357,223.09 |

| Period end date | Name of beneficiary bank | Country | Amount (USD) |

|---|---|---|---|

| Sep-14 | LGT Bank Ltd | Liechtenstein | 7,959,654.00 |

| Sep-14 | Bank Julius Baer And Co. AG | Switzerland | 4,260,000.00 |

| Sep-14 | UBS AG | Switzerland | 3,505,035.83 |

| Sep-12 | Standard Chartered Bank | United Arab Emirates | 671,828.00 |

| Oct-12 | Canara Bank | India | 99,247.00 |

| Aug-14 | Bank of Tokyo-Mitsubishi Ufj | United Kingdom | 19,322.59 |

| Dec-15 | Bank of Tokyo-Mitsubishi Ufj | United States | 12,996.00 |

| Total sent funds | 16,528,083.42 |

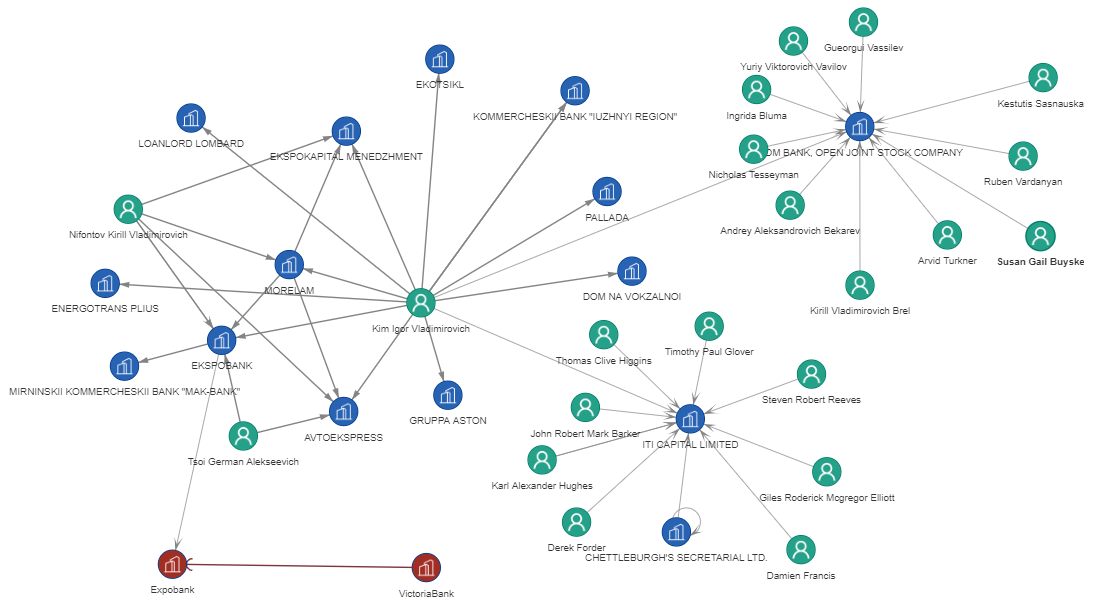

The stolen billion from Moldova: Expobank

Various media extensively covered the story of the stolen billion from Moldova since 2015. Victoribank, a leading Moldavian financial institution was at the core of the scandal. Since then, Victoriabank was acquired by a consortium including the EBRD and Banca Transilvania, a leading Romanian bank. FinCEN leaks show that Victoriabank sent 30 million USD between March and April 2015 to the Latvian subsidiary of Expobank, a Russian bank controlled by the reputed oligarch Igor Kim.

The fact that funds can be transferred from countries of the ex-Soviet bloc to the European Union is not a novelty. In fact, Igor Kim owns a bank operating (MDM bank) and global investment firm (ITI Capital), both operating in the United Kingdom. Therefore, running such transfers should not pose a problem. A significant number of high net worth individuals can offer such services due to their global network. In this matter, FinCEN leaks did not bring the key piece of the puzzle: What was the final destination of the stolen billion?

Word on the street: Semion Mogilevich

Based on FinCEN Files, ICIJ journalists claim that JP Morgan transacted between January 2010 and July 2015, over 1 billion dollars with a firm controlled by Semion Mogilevich. a reputed Russian crime figure.

Semion Mogilevich is an iconic legend of the Russian underworld and one of the top ten most wanted criminals of the planet. He had a criminal carrier spanning over few decades in various countries and social milieus. His legal issues started in the time of the former Soviet Union when he built part of his reputation. Mogilevich began to as a small-time thief and counterfeiter in the 1970's. He made his first significant illegal profits in the 1980's from Ukrainian-Jews leaving the Soviet Union. He took their art, jewellery and other valuables, promising to sell them and send the money, but kept most of the proceeds. Not long after the collapse of the Soviet Union, Mogilevich set up operations in Budapest, where he ran a prostitution ring out of a topless bar called the Black and White Club. Fast forward, Mogilevich succeeds also in America where he engineered a massive stock manipulation scam on the Canadian exchange. In the 2000s, reports showed that Semion Mogilevich had strong ties with Soltnsevo criminal syndicate headed than by Serghey Mihailkhov.

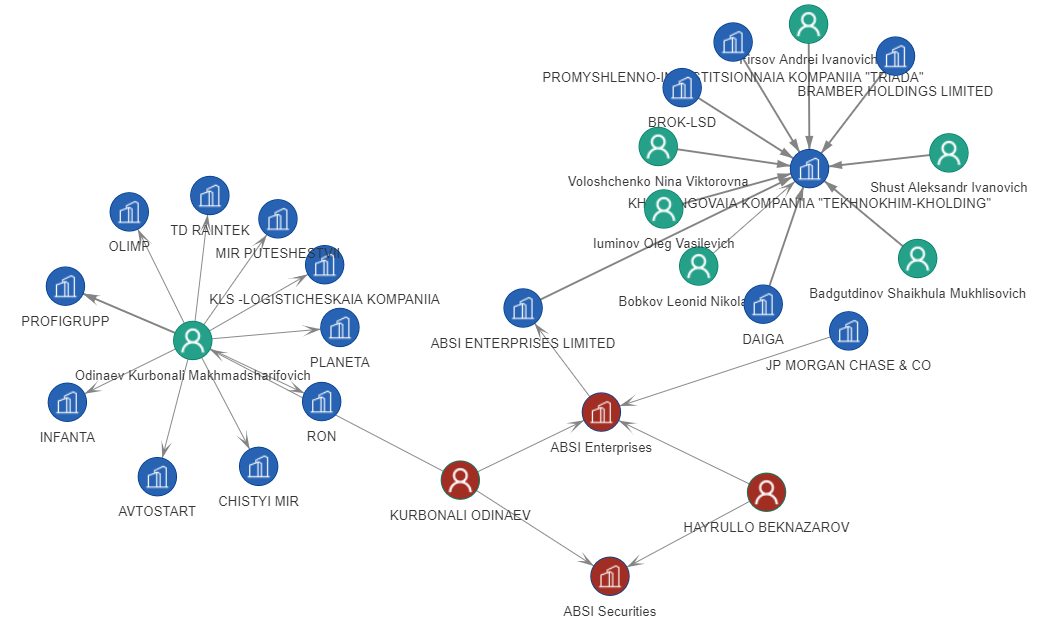

ICIJ's allegations are based on some transactions involving ABSI Securities and ABSI Enterprises, to Cyprus-based companies. Kurbonali Odinaev and Khayrullo Beknazarov are the directors of these companies. A company with a similar name exists in Russia and has ramifications with other firms. An individual under the name of Kurbonali Odinaev is the director of several Russian companies based in Moscow and Samara region.

The link between ABSI and Mogilevich is highly speculative. Conflating the ABSI companies from Cyprus and Russia and the identities behind Odinaev's name is a risky assumption. Entity resolution based solely on name matching generates a high rate of false positive.