Enron’s tragedy and Arthur Andersen's dismissal seem just distant memories from a bad dream. The Big Four were doing just fine for the past 15 years. Global accounting standards, new business control regulations and stricter compliance rules were the bread and butter for the tycoons of accounting. The troubles started in 2018 when the Securities and Exchange Board of India has banned PwC from auditing listed companies in India. Later in 2019, the Indian authorities intended to ban Deloitte and KPMG for five years over alleged insufficiencies in their audit processes.

Ernst & Young is currently caught in several stories, with no easy way out. EY was Wirecard's leading auditor in Germany. The fintech went bust earlier this year after a massive fraud scandal. The accounting firm is under pressure, as they will need to justify how they were not able to spot the illegal transactions, that defrauded the clients.

EY's name also appears in one of the cases revealed by the FinCEN Files. EY was the auditor of a Dubai-based gold trading company, which got embroiled in wrongdoings engineered with Kaloti Jewellery International. EY was sued for accounting misconduct which aimed to hide illicit exports and to cover money laundering schemes. Kaloti's name appears in connection with a SAR leaked by ICIJ, thereby making the case more difficult for EY.

The Big Four do most of their business outside the accounting practice, in what they call the advisory services or the "Channel 2", thereby providing consulting to big corporations and banks. Over the past years, the accounting firms billed hundreds of million dollars for advisory services in the field of compliance and combating financial crime. They designed KYC, anti-money laundering, transaction monitoring systems for the leading global banks. In a nutshell, the Big Four knew what was in the accounts of the top banks and how their compliance processes worked. It does not take long until regulators realize the situation does not add up and start questioning the accounting firms about their role and responsibilities in the recent events. The aftermath may be painful.

“There's no business like show business, but there are several businesses like accounting.”

David Letterman, American TV personality

Sanctions: The Rotenbergs

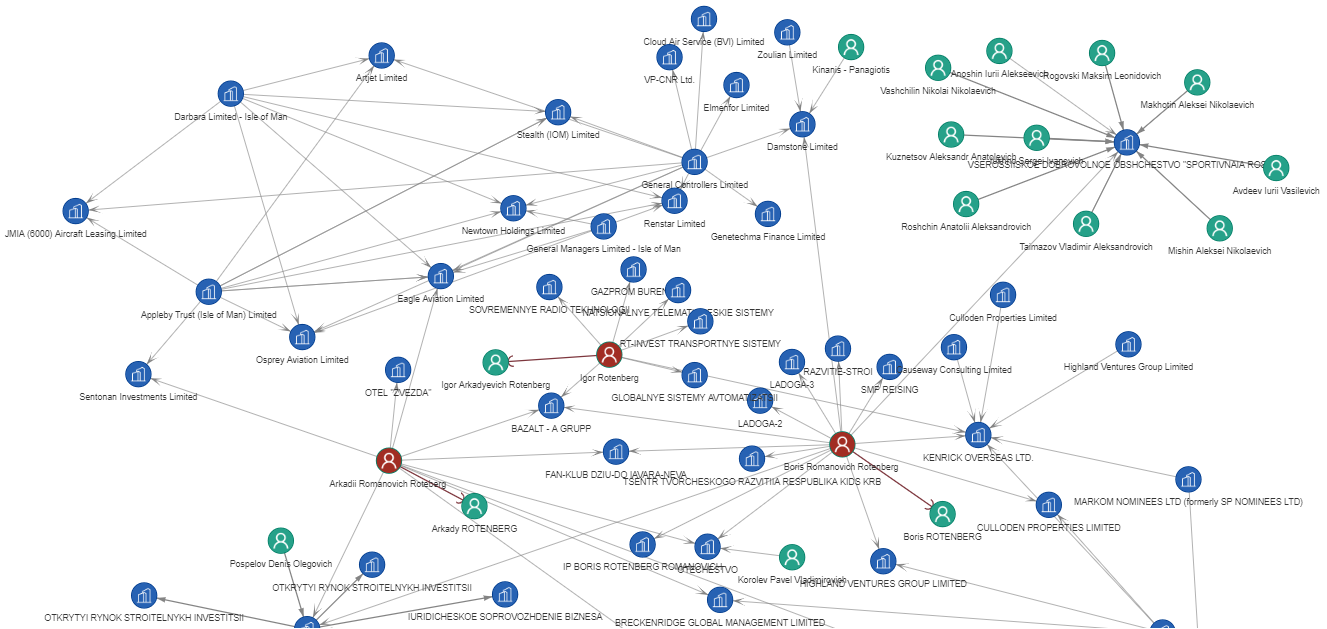

Boris Rotenberg, his brother Arkady and his nephew Igor are since 2014 on United States' sanctions list. The trio operates companies in multiple jurisdictions including Russia, the United Kingdom, Isle of Man, Marshal Islands, British Virgin Islands, Aruba, South Africa, Cyprus. Implementing the sanctions against the Rotenbergs is far from being a straightforward task. Companies that have no link with the three oligarchs could be easily part of their extended network. Therefore, banks are confronted with a gigantesque challenge when applying the OFAC sanctions for such individuals. Many offshore jurisdictions, including the British Virgin Islands, announced that they would disclose in the foreseeable future the beneficiaries of the companies incorporated in their jurisdictions. But, this will solve only a small part of the puzzle.

FinCEn Files vs Panama Papers: The Rotenbergs

Boris, Arkady and Igor Rotenberg appear in both FinCEN Files and Panama Papers. Deutsche Bank, Commerzbank, BNP Paribas and American Express are only a few of the financial institutions that filled SARs concerning the Rotenberg according to the leaked ICIJ data. The three oligarchs controlled directly or indirectly a vast network of companies over multiple jurisdictions.

Therefore, one should be cautious when analyzing the information shown in SAR, as not all connections are necessarily active. Panama Papers data shows that Igor Rotenberg controls a British based company called Stormont Systems Limited, incorporated in January 2010 that owns another British firm named Markom Management Limited with ties to Boris Rotenberg. In reality, the British registry presents a different picture. Stormont Systems Limited is, in fact, Stormont Investment. Its director is Mark Omelnitski (DOB: April 1974), his name being connected to Markom Management as well as to other firms from the Panama Papers. These group of British firms do not appear to have direct contact with the Rotenbergs, and one may need to dig for several layers to find a connection. Leaked data is, in most cases, unstructured and requires a human judgement which can often be subjective.

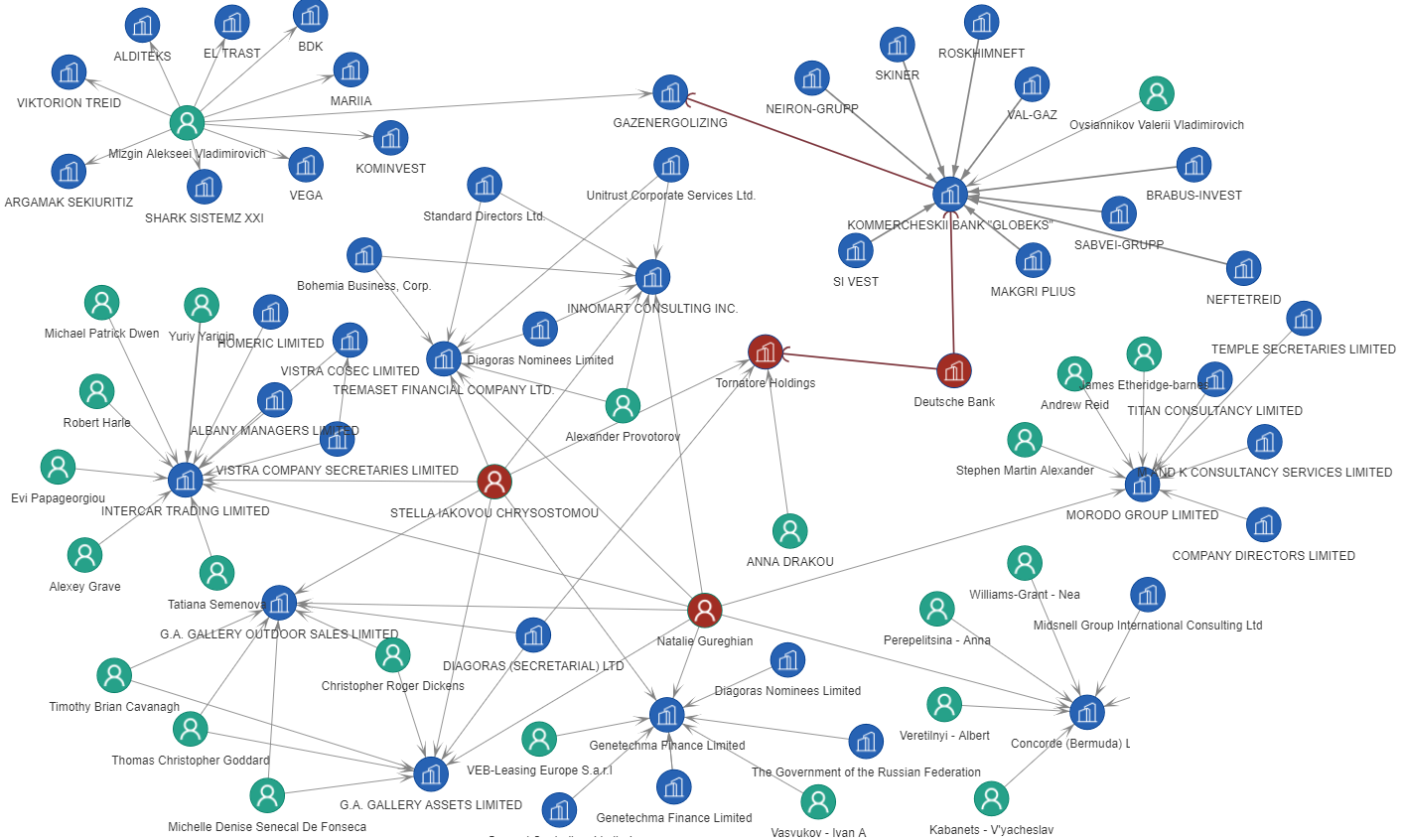

FinCEN Files: Tornatore

"Tornatore" is not the title of a Lana del Rey song. It is the name of a company that made the object of a suspicious activity report filed by Deutsche Bank in 2012 and published through the FinCEN Leaks. Tornatore Holdings is incorporated in Cyprus and executed several transactions with Gazenergolizing, a Moscow-based company. Monies from the Russian firm transacted through "Globex" Commercial Bank. Gazenergolizing is currently liquidated, and Sviaz-Bank acquired Globex in November 2018. Last week, the Russian justice sentenced Globex Bank's ex-CEO, Vitaly Vavilin to three years in prison. He was found guilty of misappropriating 12 million euros from the bank.

Tornatore seems at first sight just another Cypriot company used as a buffer by a Russian bank to operate global transactions. When analysing the network behind Tornatore's directors, things become more complicated. Stella Yakovou Christotomou (DOB: May 1966), a Cypriot citizen is managing Tornatore Holding, but also has directorships in several British companies. Natalie Gureghian (DOB. October 197) is another key person holding directorships in a few of the companies controlled by Christotomou. Both persons own a Cyprus based company called Genetechma Finance Limited which appears in Panama Papers as linked to the government of the Russian Federation and VEB Leasing Europe, a Luxembourgish company.

Offshore data shows that Genetechma is part of a network of companies controlled by the Arkadi Rotenberg. This architecture looks indeed too complicated for a straight buffer firm.

Word on the Street: “Abou-Chaker” Clan

The traditional organized crime groups including 'Ndrangheta, Sicilian mafia and Russian gangs started operations in Germany since the early 1990s. A taskforce of 300 German police officers raided last week the Berlin headquarters of the Lebanese-clan led by Arafat Abou-Chaker. The police searched over 18 properties linked to the gang as part of an investigation related to tax evasion and money laundering.

Germany, the biggest European economy is a fertile ground for new organized crime groups that are growing in economic crime. Albanian, Asian, Turkish, Northern-African, or Lebanese crime groups are operating in Germany and diversifying their activities into tax evasion and other types of frauds. The growth of various Mafias in Germany should trigger a serious alarm about the potential risks that all European countries could face in the future.