Under the extreme scenario of a “Hard & Heavy” Brexit, Britain will have no access to the Single Market and no relationship with the Customs Union. A significant consequence would be a lower level of cooperation between HMRC and the Customs offices of European countries. VAT fraud is currently one of the main areas where European cooperation is crucial. Europol, for instance, is the leading European agency gathering information and expertise for tackling tax evasion. Its role was critical to investigating a few major cases of Missing Trader Intra-Community(MTIC) fraud that overcome the competences of local law enforcement. What will VAT fraud look like after Brexit?

A hard Brexit will impact mainly the MTIC fraud, which is, by nature, a transnational crime. A Brexit involving less exchange of tax-related information across the channel would hamper the capacity of investigating MTIC cases.

Moreover, VAT fraud typologies from the pre-Common Market era could resurge. Those scams are less damaging from an economic point of view compared to MTIC. But, it could potentially lead to an increase in the frequency of small scale frauds, which would explore flaws in the domestic VAT system. If the United Kingdom is opting out from Customs Union and products and services can no longer flow freely across the border, smuggling could make a comeback.

A previous investigation of the EU’s anti-fraud unit (OLAF) from 2018 brought evidence that goods imported from China were being deliberately undervalued in the British ports of Dover and Felixstowe, to avoid the payment of VAT, through the Low-Value Custom Relief (LVCR). OLAF alleged that Chinese exporters used Great Britain as an entry gate in the European Market, where they can inflow their merchandise at very aggressive prices.

The role of LVCR and Mini One-Stop-Shop (MOSS) schemes and the way Britain will position on these topics will play a key role in defining the future spectrum of VAT evasion.

VAT scammers will find new fraud opportunities in the turmoil that will follow Brexit. With Gulf countries opting for VAT since 2018, the dimensionality of VAT fraud in the United Kingdom will increase after Brexit. The Dubai Connection is a recurrent pattern in many VAT fraud cases, and with the current perspective, this connection will require more efforts to be taken down. Law enforcement agencies from the United Kingdom, Continental Europe and Gulf countries are not yet prepared to face this potential complexification of VAT fraud typologies.

The post-Brexit transitional period, during which Great Britain would rely on the European legal framework for VAT purposes, would be critical with regards to VAT fraud. Criminals will most likely try to exploit the legal vacuum for accelerating the current MTIC scams.

Under the scenario the United Kingdom keeps its VAT system, the amount of collected VAT will follow most-likely a “J-curve” in the post-Brexit years. Under all hypotheses presented above, in the short run, the losses due to VAT fraud will increase in the years after Brexit. Spillover effects could eventually occur in the European countries that will keep a high trading balance with the United Kingdom. Those countries could also observe in the short run a decrease in the collected VAT.

In the long-run, the flaws generated by Brexit will be progressively corrected and the gates opened to fraudsters will be gradually be closed. Thus, the opportunities for VAT fraud will be reduced. Moreover, if the goods will not be able to circulate freely after Brexit, there are good chances that the size of the MTIC will decrease in the long term.

“With a post-Brexit economic policy that sets our economy and country on the right track, with new freedoms, the U.K. will exercise greater fiscal flexibility and regulatory reform to transform our country into a dynamic engine of prosperity, job creation and growth.”

Priti Patel, British Secretary of State for the Home Department

Focus: Nazarbayev’s empire in London

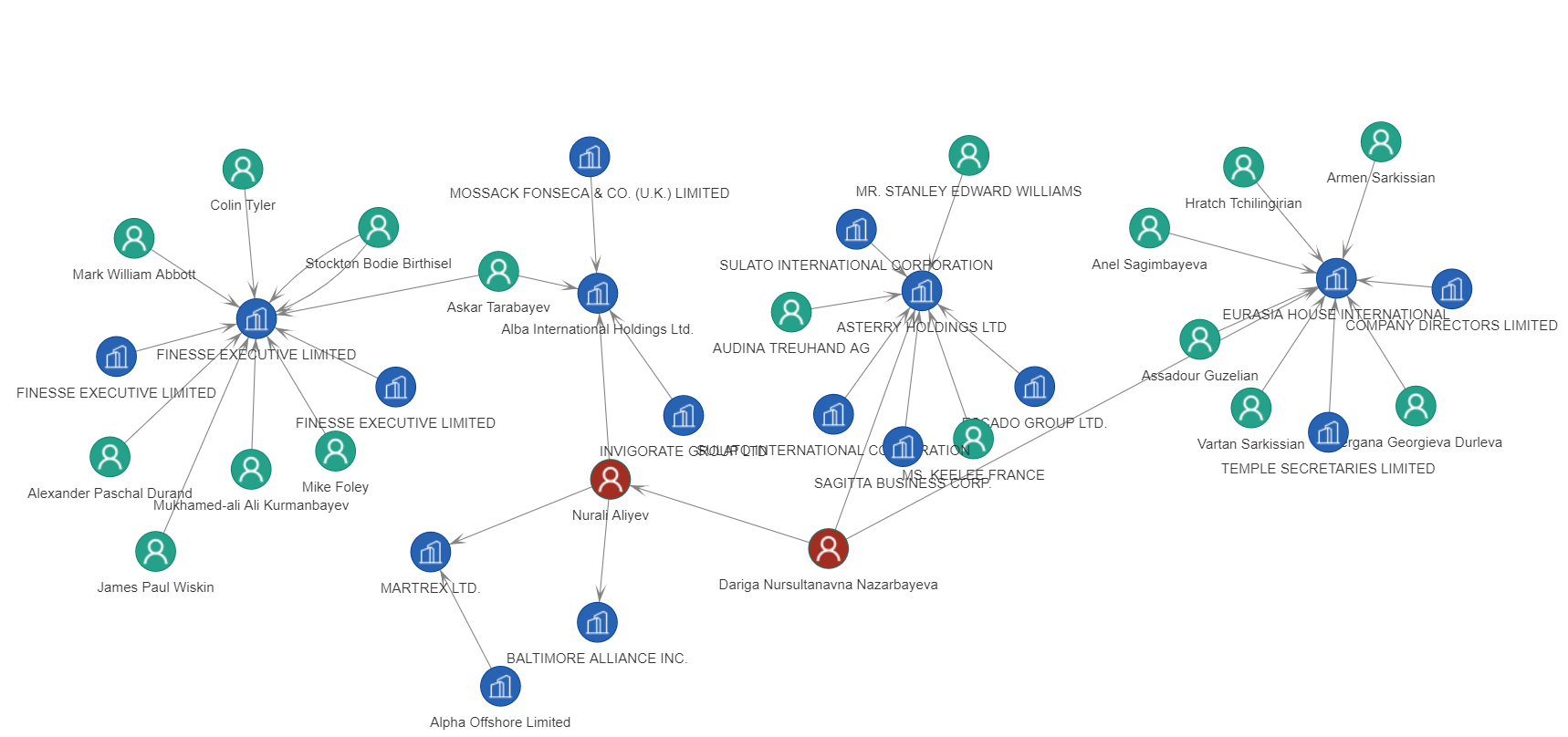

Nursultan Nazarbayev ruled Kazakhstan, Central Asia’s most prominent and richest country over three decades. In 2019, Nazarbayev stepped down and relinquished power amid an alleged silent tactical conflict with Moscow. His legacy will remain, and history will member him as the founder of modern Kazakhstan, a nation which flourished in the late 2000s due to its immense oil and gas reserves. The British journal The Times published an intriguing article about Nazarbayev’s daughter Dariga and her ventures in London recently. Dariga controls a British based company called Eurasia House International. She and her son Nurali are involved with several offshore firms incorporated in Liechtenstein and the British Virgin Islands. Like many tycoons from the ex-Soviet republics, the Nazarbayevs disseminated their wealth across various jurisdictions using various buffers and intermediaries. Time will tell if, in the current geopolitical context, the Crown will issue an Unexplained Wealth Order against Nazarbayev’s’ interests in London.

Word on the street: Wildlife traffic

Asia is a different continent from many points of view. One particularity is that many Asian countries have illegal markets for wild animal parts. The scarcer a specie is, the higher its price on the black market. Threatened or near-threatened felines are amongst the most praised items for their alleged medicinal properties. Chinese buyers spend huge amounts of monies on bones, genitals and teeth from wild felines.

In the 1990s, Central Asian countries saw a significant number of tourists-poachers hunting snow leopards also known as irbis. This mysterious feline leaving at high altitudes in the Tien Shan mountains became almost extinguished. Sighting or taking a picture of an irbis represent a trophy.

Recent reports show the existence of new traffics of jaguar parts from South American countries to Asia. The cocaine prices plummeted amid the pandemic outbreak, due to lower demand in Western European countries. The South American cartels, the primary providers for European consumers, may need to reassess their options and to reconsider other avenues for generating profits. Wildlife traffic and feline parts, in particular, might not make big turnovers, but for sure the margins are attractive.