The end of the Cold War in the early 90s brought massive restructuring in the military forces of the North Atlantic Alliance. Thousands of professional soldiers became unemployed. The private sector took advantage of this available well-trained workforce, thereby creating the first private armies. Executive Outcomes, Blackwater and Armor group are only a few of the private military service providers (mercenaries) that became known over the past decades for their adventurous endeavours. A similar trend is also observed for the intelligence services.

A few decades ago, intelligence services were provided exclusively by agencies placed under the strict responsibilities of national governments. Budget constraints and the need for non-governmental intelligence were the main reasons private agencies saw more substantial development. In the late 1990s, governmental agencies began outsourcing par f their strategic operations to specialised companies, including Booz Allen Hamilton, CSRA, Science Applications International Corporation (SAIC) and CACI International. The services provided by most of these companies are technology-related and do not include fieldwork.

| Agency | Country | Description |

|---|---|---|

| Booz Allen Hamilton | United States | A provider of management and technology consulting services. It is one of the main contractors for the American National Security Agency |

| Black Cube | Israel and United Kingdom | Founded by ex-Israeli intelligence officers, the firm is reputed for its cutting-edge methods and for working for The British tycoon Vincent Tchenguiz |

| AEGIS | United Kingdom | Private military and intelligence service provider with significant interventions in Iraq and Afghanistan |

| Kroll | United States | Pioneer of the intelligence and investigation services |

| K2 Intelligence | United States | Founded by James Kroll’s sons, the firm offers investigative, compliance, and cyber defence services |

| Groupe GEOS | France | Specialised in operations on the African continent |

| Control Risk | United Kingdom | Founded in 1976, the firm is specialised in crisis management and political risk |

Moreover, with the rampant threats of financial crime, private companies and especially financial institutions had increasing needs in intelligence services. Many banks opted for internalising these services with the creation of intelligence units. But, the reliance on third party intelligence providers is the primary trend.

London is the leading marketplace for private companies that need to purchase these services. Law firms, investment managers and international trading firms are only a few of the many businesses consuming this service. Anglo-American firms dominate the intelligence market, GEOS being the French exception. In the beginning, the private intelligence agencies were diversified military services provider or technology solution suppliers. Over the recent past, the providers became more specialised and niche services.

A pioneer pure-player in the private intelligence is Kroll, founded in 1972 by James Kroll in New York. Currently, Kroll’s turnover is over 1 billion USD in an industry with a market of over 19 billion USD.

Two major trends are identified with respect to the modus operandi of the private intelligence agencies. On the one hand, there are agencies relying massively on technology encompassing web data mining and network security. The Israeli army with its famous Unit 8200 is one of the main pools of talent for this type of agency. On the other hand, there are the old school agencies that propose field agents, underlining the key value of the human factor. Police forces and ex-intelligence officers represent the main pool of recruitment for the latter category. The two approaches are not mutually exclusive.

Most of these services are used by legitimate companies for externalising enhanced due diligence or for in-depth investigations. The question that comes up is whether criminal groups could use these services?

In some cases, individuals under investigation hired private intelligence agencies to help to fight their cases. It is the case of two British tycoons: the brothers Robert and Vincent Tchenguiz. In March 2011, a team of the Serious Fraud Office, composed of 135 police officers, entered with a warrant the mansion owned by the two brothers in London’s posh district Mayfair. The subpoena aimed to gather proof concerning the involvement of the Tchenguiz brothers in the bankruptcy of the Icelandic bank Kaupthing in 2008. Faced with this accusation of foreseeing a liability of more than 2 billion euros, Vincent Tchneguiz hired the Israeli firm Black Cube. Black Cube’s work on responding to the investigation was a success. The case against the Tchenguiz brothers was dropped and the Serious Fraud Office was requested to pay over 3.5 million USD. Furthermore David Green, the head of the Serious Fraud Office apologized publicly for the actions of his agency.

The example mentioned above refers to one case where a private individual used a private intelligence agency to enforce the defence against a criminal investigation. The market of intelligence services is very fragmented, with many small firms counting three to five agents. Most of the agents are ex-intelligence officer or ex-law enforcement.

It would not be unrealistic, in the near future, to witness cases where criminals are hiring ex-intelligence officers or even private intelligence agencies. The reasons for doing so are multiple.

Financial crime and social engineering will most likely intersect in the near future. Techniques used by intelligence agencies would be relevant for large scale social engineering.

Second, the more complex the fraudulent scheme is, the better justified the services of a private agency are. Sophisticated money laundering frameworks involve establishing a complex network of companies, directors, bank accounts and addresses. Maintaining and mapping the links in these networks over a relatively long period is a difficult task. The technology used by private intelligence firms is a real asset in this context.

Last but not least, being one step ahead of tax authorities or law enforcement would confer a great advantage to any criminal. Field intelligence work can provide significant information on the next move of authorities or major policy and regulatory changes in a given market. Organised financial crime would need to navigate the vicious meanders of transnational crime, thereby making intelligence services indispensable.

Focus: Meinl Bank

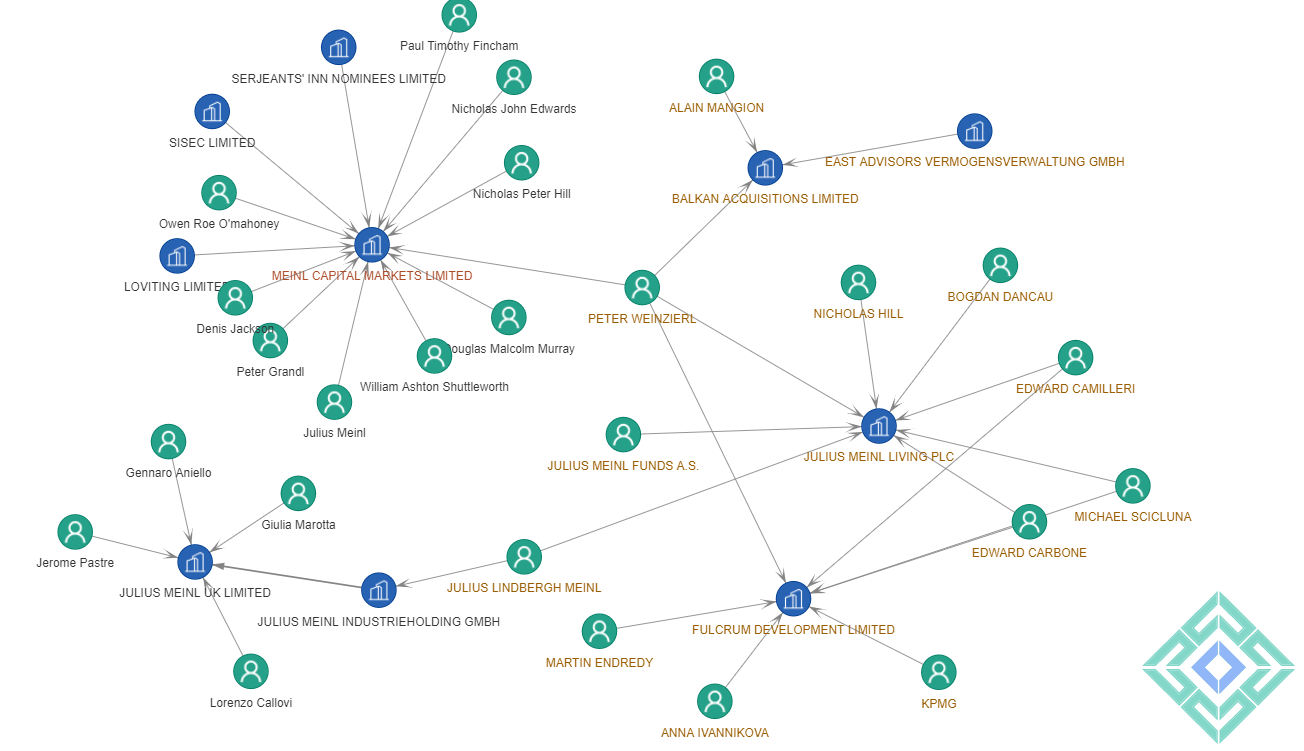

Julius Meinl’s names may not ring a bell for most of the readers. But if you are based in the Balkans, you have probably noticed that most coffee shops are supplied by one of Julius Meinl’s company. Julius Meinl V was the CEO of the Meinl Bank, a prominent Austrian private bank, currently known as the Anglo-Austrian Bank. In March 2020, the bank created in 1028 declared bankruptcy after the ECB withdrew its banking licence for involvement in money laundering. The troubles have not ended here. Peter Weinzierl, the former CEO of Meinl Bank, was arrested last week in the United Kingdom on criminal charges for his alleged role in a massive money-laundering scheme involving a Brazilian construction company.

Policy: Global minimum tax of at least 15%

G7 finance ministers agreed last week in London upon a global corporate tax of at least 15%. Each country, including the UK, France, Italy, Canada, Germany, Japan, and the US, will enforce this policy. It is the first step in a series of decisions aiming to harmonise taxation at the global level and diminish the tax avoidance and tax optimisation used by many global companies.

The word on the street: Vasil Bozhkov

The US Department of the Treasury’s Office of Foreign Assets Control sanctioned for acts of corruption Vasil Bozhkov, Bulgaria’s richest person. The application of the Global Magnitsky act included two other prominent Bulgarian citizens: Delyan Peevski, a media tycoon and Ilko Zhelyazkov, ex-head of intel. Bozhkov s a highly controversial public figure with alleged ties to Bulgaria’sunderwrold. He was involved in several cases of corruption of money laundering and is currently residing in Dubai.