Bullish stock market, monetary inflation, social turmoil… The roaring twenties marked the collective unconscious with their unprecedented violence and rampant crime. There are many similarities between the post-WW1 era and the current socio-economic context. Both periods represent a fertile ground for the development of anti-social activities. Will this decade bring a crime spree? Will the 2020s be like the roaring 20s?

The roaring 1920s, the decade that preceded the Great Depression, was prolific for stock investors. Similarly, the current decade generated an investing frenzy, propelled by central banks’ quantitative easing. Never before in history have private individuals invested more money in different financial markets. But, the stock market frenzy attracts a high number of frauds. It is key to remember a few milestones in financial delinquency from the 1920s:

- 1920: Allan Ryan was an investor in Stutz Motor, a famous car company. He successfully short squeezed the shares of the firm. The intervention of the NYSE suspended the trading, thereby plunging the firm into default.

- 1920: Charles Ponzi developed a pyramidal scheme, known today as a Ponzi scam, promising huge returns to investors.

- 1922: Clarence Saunders, the founder of the grocery network Piggly Wiggly, tried to corner the stock of his own company based on a huge loan. The corner failed and the company defaulted.

- 1929: Clarence Hatry was a reputed British financier, indicted before the Black Tuesday for fraud and underwriting fraudulent stocks.

Following the Wall Street Crash of 1929, the United States adopted the first major federal law regarding securities trading, called the Securities Act of 1933. The Act aimed to bring more transparency in the financial statements of firms for insuring the investors and to tackle the misrepresentation and fraudulent activities in the securities markets.

While regulation protects the vested interest of retail investors in traditional financial markets, the more modern and innovative investment supports such as crypto-currencies, NFT and other non-regulated products expose unsophisticated investors to massive risks.

The sudden increase in the monetary mass, the rampant inflation as well as the significant mutation in the real economy, force private individuals to transform their savings into investments. These are perfect times for scammers and fraudsters to propose rogue investments to averagely informed individuals.

Moreover, since the pandemic outbreak, a significant number of people have vanished from the workforce. In the case of the United States, the number of workers MIA is estimated above 5 million. Such a big number of people leaving the traditional workforce raises serious concerns about whether those individuals will get involved or not in illegal activities. The 1920s showed that when the formal economy could not absorb the soldiers returning from WW1, they engaged in the informal economy including criminal activities. Governments are cheering for the so-called gig economy because it leads to lower unemployment numbers. But, in reality, the informal economy opens the avenue for bending the rules of business and ultimately to criminal activities.

The circumstances in the early 2020s tick all the boxes that could make from the next decade an era that will be remembered for the unprecedented level of financial crime. Will this economic crime spree trigger the next market crash? How big will it be? How many people will lose all their savings?

“You know, the period of World War I and the Roaring Twenties were really just about the same as today. You worked, and you made a living if you could, and you tired to make the best of things. For an actor or a dancer, it was no different then than today. It was a struggle.”

James Cagney, American actor

Focus: Shafqat Majeed

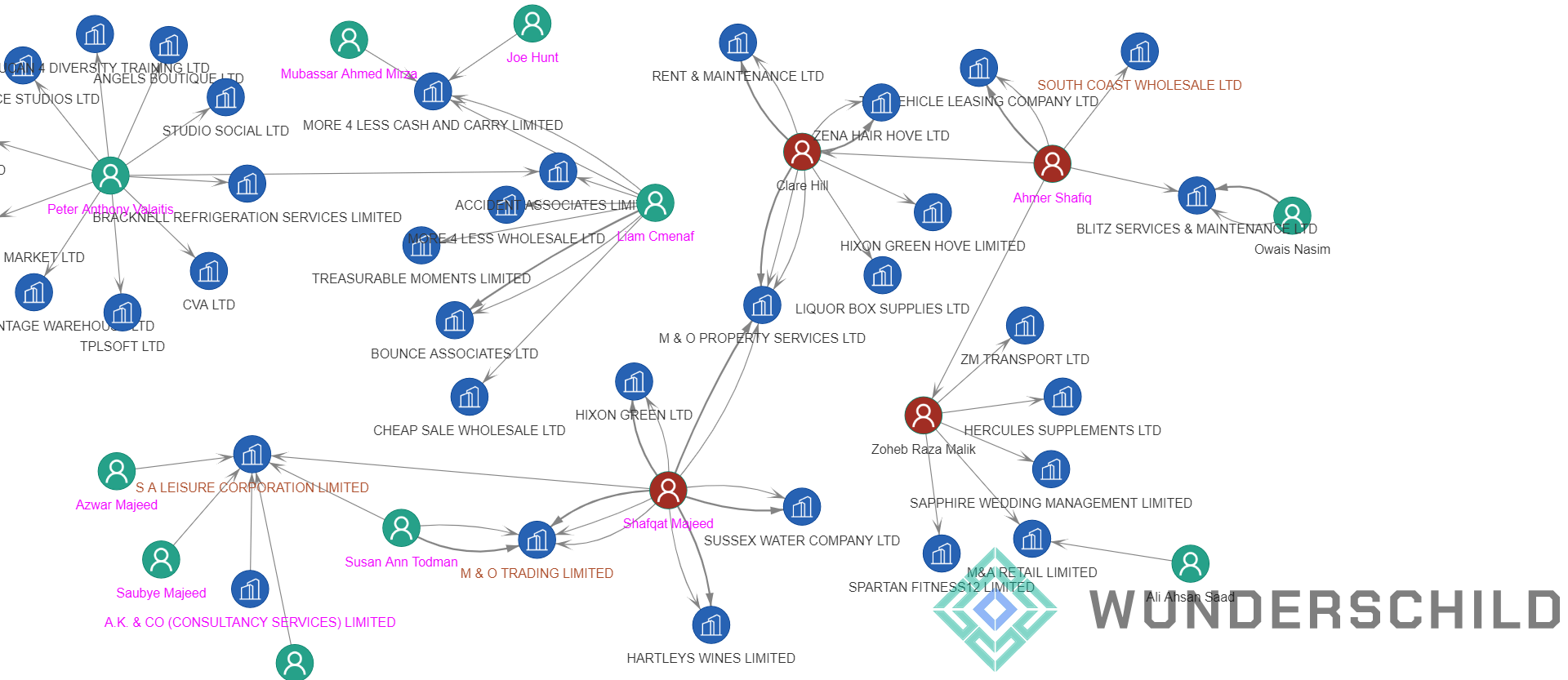

An investigation by HM Revenue and Customs dismantled a gang led by Shafqat Majeed specialized in VAT and excise fraud on alcoholic beverages. The trial and sentencing hearings at Southwark Crown Court underlined that the gang used a sophisticated network of fictitious businesses and created a trail of false paperwork on an industrial scale to cover up the fraud. The criminal smuggled huge amounts of illicit alcohol into the United Kingdom and pocketed more than 16 million GBP from taxpayers money.

Shafqat Majeed, the brains of the outfit, used over ten individuals to control a network of companies. The alcohol smuggled in the United Kingdom was sold via a wholesale company called South Coast Wholesale Ltd, controlled by Ahmer Shafiq, one of Majeed’s associates. The gang has stolen more than 4.8 million GBP in VAT and evaded paying 11.9 million GBP in excise duty.

Word on the street: What is going on in Rotterdam?

Dutch customs discovered last week in the port of Rotterdam over four tonnes of cocaine hidden in soybean bags, thereby constituting the biggest seizure of the year. The narcotics carrying a street value estimated at 313 million euros, were discovered in a container shipped from Paraguay for a company in Portugal, via Uruguay.

Until very recently Spain was the main European hub for cocaine smugglers. But, over the past years, the Netherlands and Belgium have become the main gateways for drug trafficking. Thus, the port terminals of Rotterdam and Antwerp are the preferred points of transit for cocaine shipments on the continent. The global crisis in the shipping industry seems to have no effect on the inflow of cocaine. While the central narrative is that drug dealers are using maritime freight to smuggle the drugs, it is very likely that crime syndicates may own a fleet of ships for such operations.