Gig economy, side hustle, dropshipping, digital marketing... The pandemic outbreak has changed not only the social habits but also the underlying mechanisms of the real economy. The drift from traditional employment towards a more democratised system of global service providers accelerated over the past year. Financial crime and money laundering, in particular, has also switched from a centralised pyramidal modus operandi to a decentralised and distributed approach.

Economy and crime are both globalised. Therefore a material threat in one country will eventually affect other regions of the world.

With the ever-growing digitalisation of the economy and the democratisation of financial services, we are indeed witnessing a strange phenomenon of “uberisation” of financial crime. Laundering money or financing terrorism become decentralised and persons and companies from all walks of life can be knowingly or unknowingly engaged in illegal endeavours;

Financial crime is the first beneficiary of the new “gig economy”. How does it work in practice?

With the increasing pressure of law enforcement, fraudsters prefer to avoid big financial institutions and cross-border transfers of significant amounts of currency. What other avenues are available? The plethora of agents active in the gig economy is the perfect cover for moving and laundering money. A transfer of 10 million EUR from a Chinese private bank to a European neobank would look suspicious. But if this amount is split in 10,000 transfers of 1000 EUR each operated by Alibaba drop-shippers it would be practically impossible to get traced.

We all know that margins in online merchandise trading are thin, so those influencers preaching financial independence through e-commerce are not reselling tea bags with one-cent profit. There are other agenda behind all these programs and given the ramping cost of money laundering, engaging in such endeavours could be more than profitable

Ubersation is not a new phenomenon. Terrorism finacian changed dramatically its modus operandi over the past two decades and since 2015, uber-terrorism has become the main approach used by extremists.

When dealing with such threats, governments should encourage their underlying intelligence agencies to share proactively critical information with companies that are in the front line of the war against financial crime.

“The gig economy is empowerment. This new business paradigm empowers individuals to better shape their own destiny and leverage their existing assets to their benefit.”

John McAfee, English-American computer programmer and businessman currently indicted for tax evasion

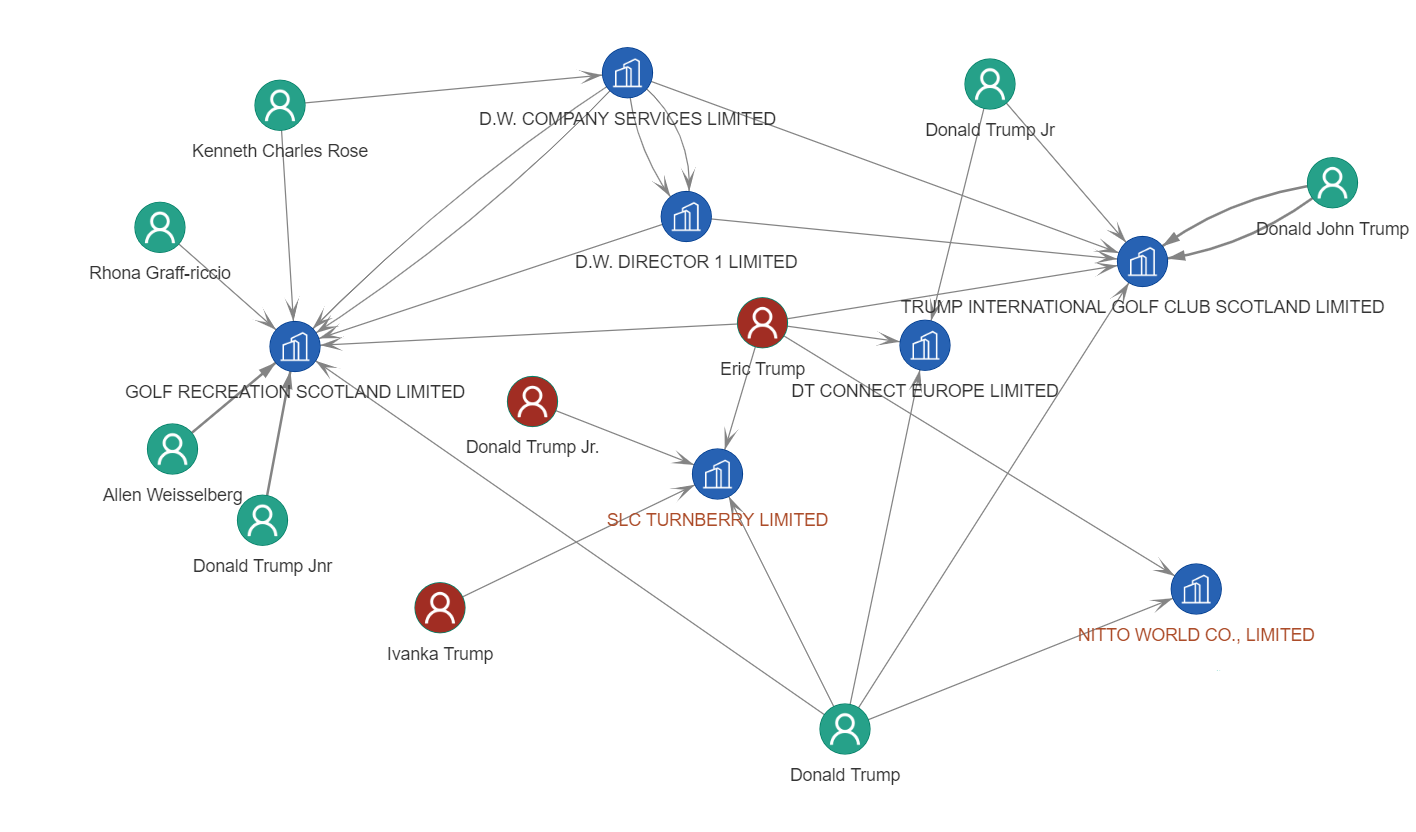

Focus: Donald Trump’s endeavours in Scotland

Losing the 2020 reelection signalled the beginning of the ordeal for the Trump clan. Before his political endeavour, Donald J. Trump (DOB 1946) was a reputed real estate developer. Amongst its investments, Trump along with other members of his family initiated a golf project in Scotland.

In February 2021, the Scottish government rejected a request to investigate the source of wealth of the formùer US President. He purchased two golf courses in the early 2010s but less is known about how he financed the deals.

Avaaz, an NGO focused on advocating human rights was at the origin of the legal action filed in Scotland’s highest civil court aiming to lead to an “unexplained wealth order” on Trump’s business.

The Trump Organization bought the golf courses in 2006 and 2014, through various companies incorporated in the United Kingdom. All the members of his family including Ivanka, Erik and Donald Jr appear amongst the person with significant controls in these projects.

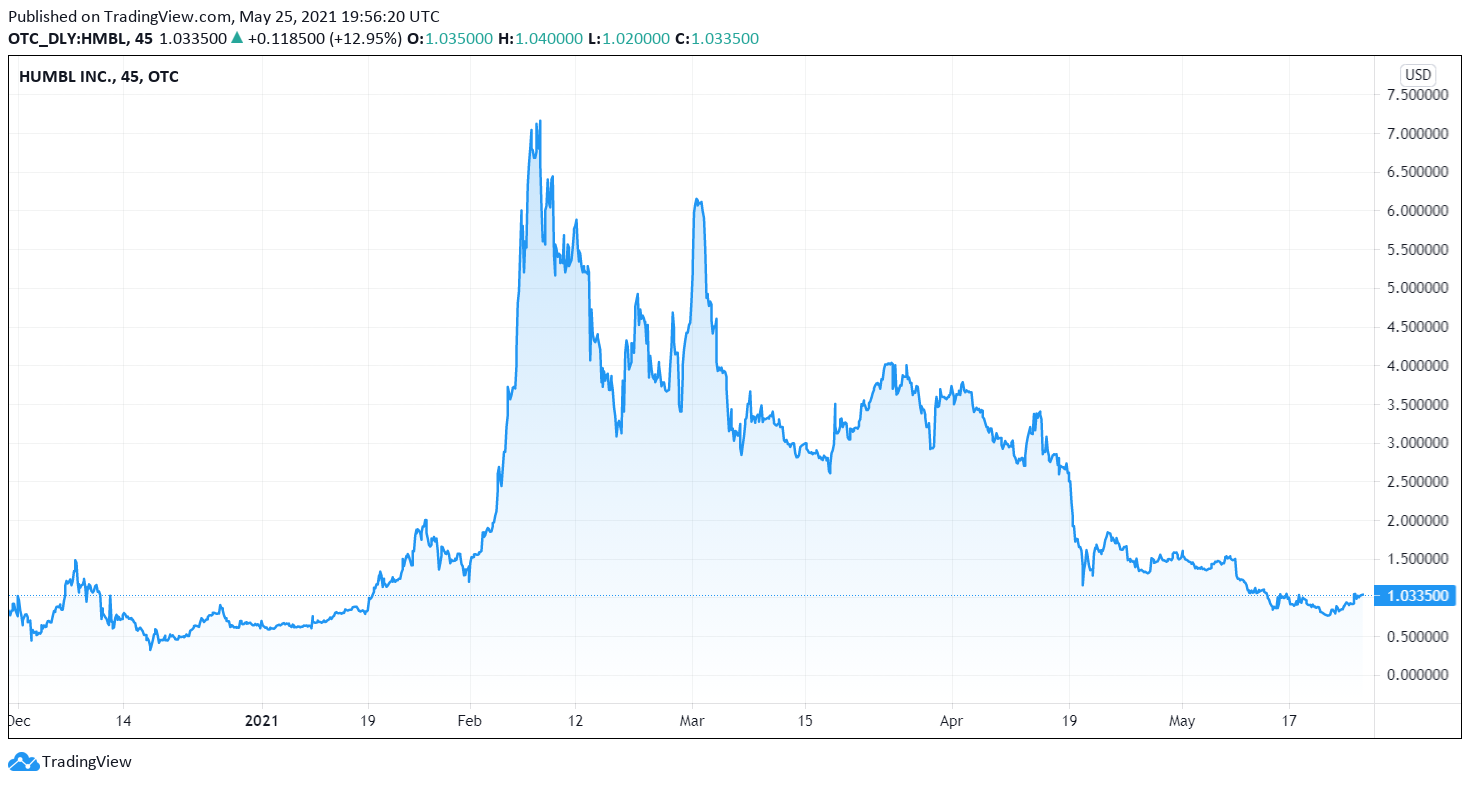

Focus: Unhumble HUBML

SPAC, direct listing, equity crowdfunding… The avenues for fundraising amid the COVID-19 crisis are multiple. It has never been easier in modern history to access the capital markets and it has never been harder for an investor to assess the reality beyond an investment. One of the by-products of the pandemic outbreak is the epidemic of listed stocks with no underlying business.

Humbl is such an example portrayed in one of the last issues of Hindenburg Research. HUMBL is a SanDiego based early-stage fintech company with a 5.6 billion USD market capitalization but with no revenue in 2020. Seemingly the fintech has not delivered the promised functionalities and does not seem to add value compared to its competitors. HUMBL’s share price plunged since February 2020 amid a strong rally on tech values. Many other listed stocks will follow the same path when the tech investing frenzy will come to an end.

Word on the street: Knights of Coke (IV)

The Brasilian police operated another high profile arrest. Rocco Morabito, 54, known as 'u tamunga is a fugitive criminal representing ‘Ndragheta’s interests in South America. He was arrested in a hotel room in the northeastern coastal city of João Pessoa, along with another Italian fugitive. Throughout the 1990s, Morabito commingled with Milan’s jet-set stars and financiers. He was the first hand supplier of cocaine for the Lombarina elite circle, thereby getting the name of “Cocaine king of Milan”.

Morabito became a fugitive in 1994 when he was indicted for international drug trafficking. He escaped to Brazil and finally, he landed in Uruguay where he lived in Punta del Este and remained under the radar for almost two decades. In 2017, he was arrested by the Uruguayan law enforcement, but managed again to escape and moved back to Brazil, given the fact that he was most likely holding Brasilian citizenship. He enjoyed his freedom, until earlier this week when he was arrested following a joint operation of Interpol, the DEA and the FBI.

Needless to say, Morabito is one of the many members of ‘Ndrangheta with ties in South America that constitute the value proposition team and act as cocaine brokers between the drug cartels and wholesalers from different European countries.